Recent Newsletter Articles

-

#60 Yield on Cost vs Cash-on-Cash and IRR

—

by

You’re likely familiar with the challenge of evaluating investment opportunities. With sponsors presenting different metrics to showcase their deals, it’s crucial to understand which numbers truly matter for your investment decisions. Recently, Yield on Cost (YoC) has gained popularity, with some sponsors even suggesting it should be the primary metric for evaluating deals. But is…

-

#59 Book Review: Finish: Give Yourself the Gift of Done

—

by

Most of us have a pile of half-finished projects and abandoned goals. With this being the season where most new resolutions are added to that pile, I wanted to share a book that helps you stay on track and accomplish your goals. In his groundbreaking book “Finish: Give Yourself the Gift of Done,” Jon Acuff…

-

#58 Two Unfortunate Trends in Sponsor Communication

—

by

As passive real estate investors, we often focus on the numbers – IRR, equity multiples, and cash-on-cash returns. But I’ve discovered that a sponsor’s communication patterns can tell you more about their operational excellence and investment philosophy than any pro forma. Recently, I’ve observed two concerning trends in sponsor communications that every Limited Partner should…

-

#57 Note Investing 101

—

by

One of my favorite asset classes for cash flow is notes – also known as mortgages, hard money loans, or private money loans. Think of it as becoming the bank – without the bureaucracy. There are two common ways to invest in notes. The first is to invest directly in a specific note against a…

-

Breaking the “Never Sell” Myth

—

by

You’ve heard the conventional wisdom – “never sell your real estate investment” – but is that always the right move? Spoiler alert: It’s not. Absolutes are rarely your friend. As with any professional activity, real estate investing requires continuous optimization, strategic thinking, and a willingness to evolve your strategy. As an investor, you need to…

-

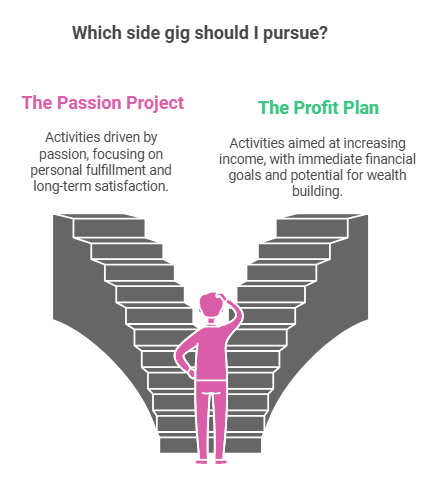

Side-Gigs: Passion Project, Profit Generator, or Both

—

by

For many successful tech professionals, the idea of starting a side gig can be both appealing and confusing. While your day job provides a comfortable income, you might find yourself drawn to additional ventures – whether for passion, profit, or both. However, before diving in, it’s crucial to understand what truly drives this desire. From…

-

Consistent strategy, evolving tactics

—

by

There is a fundamental difference between your overall strategy – the long term vision of what you want to do – and the tactics that you use to make progress on that strategy. My strategic vision has been to I use my personal investment philosophy [1] as the framework within which I take action. The…

-

Book Review: The Lifestyle Investor

—

by

I recently re-read The Lifestyle Investor by Justin Donald [1]. While a new version of the book came out n April, I read my copy of the original.

-

How compounding supercharges your net worth

—

by

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it,” is a quote attributed to Albert Einstein. Whether he actually said it or not is unclear [1].