Recent Newsletter Articles

-

#69 My Take on Gold and Silver

—

by

Gold has captured headlines again, soaring past $3,200 per ounce and touching $3,500 in April—a dramatic climb from under $2,400 just one year ago and under $2,000 two years back. While the financial media buzzes with predictions of continued growth, it is important to filter out the noise and intentionally decide what role precious metals…

-

#68 The Abundance Approach to Tax Strategy

—

by

For high-income professionals, taxes represent one of your largest annual expenses—yet most assume nothing can be done to reduce this burden. This assumption can cost of thousands of dollars each year, money that could be accelerating your journey toward financial independence through strategic investments. The reality is that intelligent tax optimization can save you $20,000…

-

#67 Automating Your Path to Financial Freedom

—

by

Not everyone enjoys dedicating substantial time to thinking about investing. This is perfectly understandable. Your professional responsibilities, family obligations, and everyday necessities create constant demands on your limited time and mental energy. When precious free moments arise, you want to relax and enjoy them—not analyze financial documents, evaluate investment opportunities, or study investment principles. The…

-

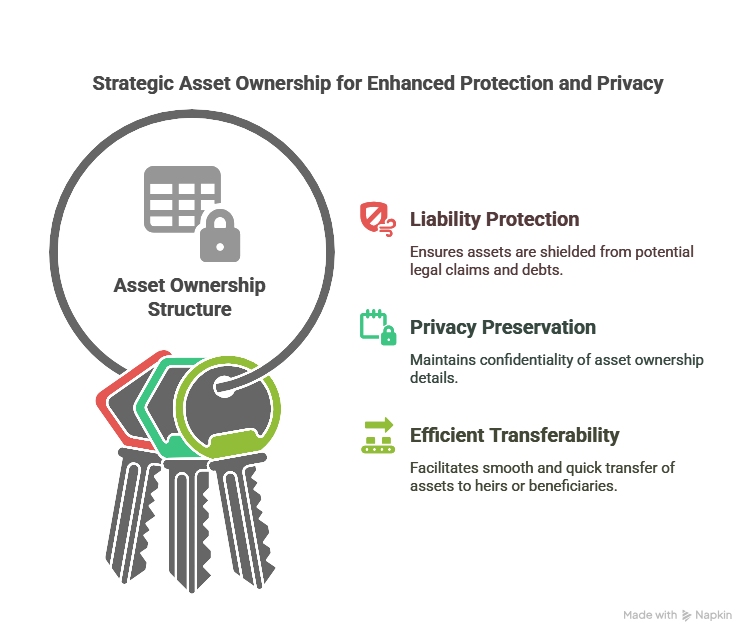

#66 Strategic Asset Ownership: Protecting What You Build

—

by

When you purchase an asset, one of the most fundamental decisions you face is how to hold that asset—determining who will be the owner of record. This decision might seem trivial early in your investing journey when you simply hold everything in your name. As your portfolio grows, however, the structure of ownership becomes increasingly…

-

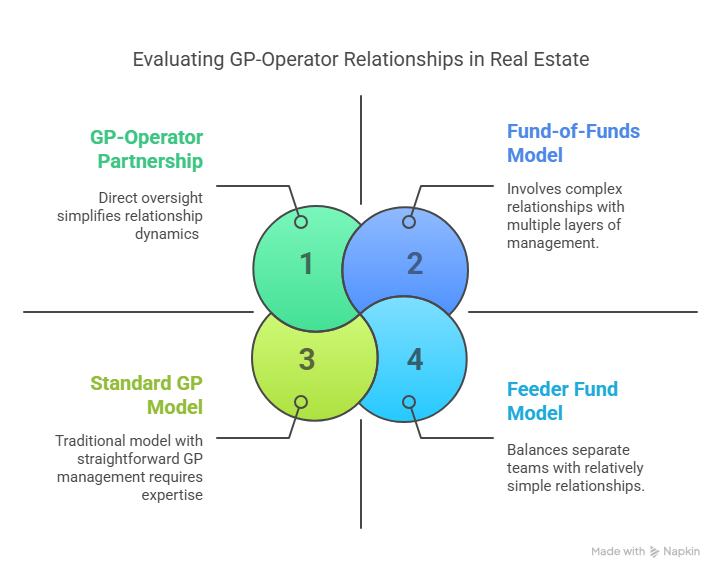

#65 Understanding GP-Operator Relationships: Critical Due Diligence

—

by

When conducting due diligence on a real estate investment opportunity, looking solely at the General Partner (GP) team provides an incomplete picture. Understanding who operates the property and the relationship between your GP and these operators is equally critical. This relationship can significantly impact your investment outcomes, yet it often remains overlooked by inexperienced investors.…

-

#64 Book Review – Tiny Habits

—

by

When building wealth while maintaining your professional career, your most valuable resource is not capital—it is your time, including the habits you fill your day with. B.J. Fogg’s “Tiny Habits: The Small Changes That Change Everything” [1] offers a refreshingly practical approach to behavior change. As a Stanford researcher who has studied behavior for decades,…

-

#63 Establishing Your Investment Thesis – Part 3: Determine Your Tactics

—

by

Now that you’ve established your goals and overall investment strategy, it’s time to translate them into actionable tactics. This chapter will guide you through creating your investment thesis—a personalized framework that will serve as your financial compass for years to come. In particular, you need to establish your ideal: Design Your Portfolio Allocation The fundamental…

-

#62 Establishing Your Investment Thesis – Part 2: Clarify Your Strategy

—

by

“The most important investment you can make is in yourself.” — Warren Buffett Once you understand the goals for your investments [1] it is time to clarify your overall investment strategy. Building on the work of my mentors [2], I have identified five dimensions that combine to form the space of possible investments. Consider these…

-

#61 Establishing Your Investment Thesis – Part 1: Define Your Goal

—

by

While having a full-time job with a substantial paycheck is great, you are still trading your time for money. In order to break your paycheck dependency, you need to develop a strategy that puts your hard earned income to work for you. This article provides the first step in developing your personal investment thesis. At…