Recent Newsletter Articles

-

#78 Why I Believe In Syndications

—

by

As most of you know by now, I am a strong advocate for investing in syndications. After 30 years of studying real estate investing and transitioning from active property ownership to passive investing, I credit my syndication investments with allowing me to retire just six years after I began investing in them. However, you may…

-

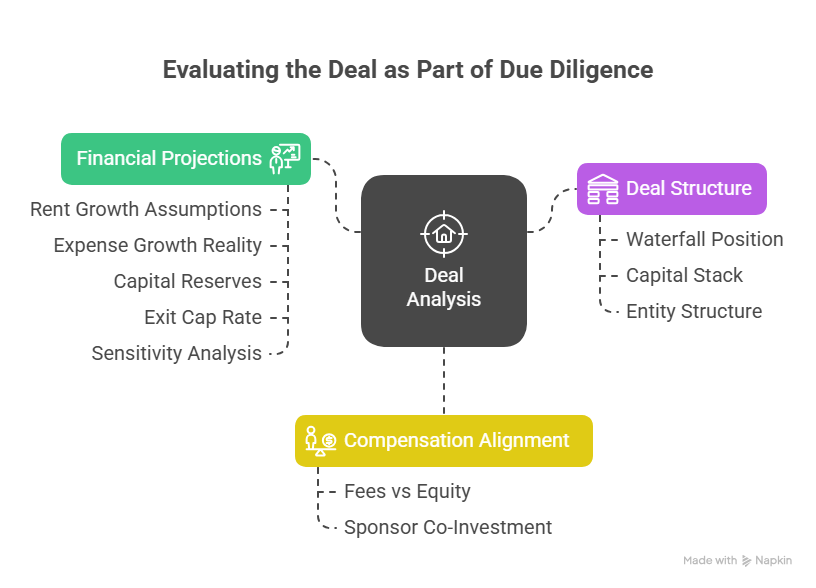

#77 Due Diligence: Evaluating the Deal Itself

—

by

Assuming that the sponsor has passed your review [1] and the property meets your investment criteria [2,3], you have reached the final steps in your due diligence journey. The opportunity looks promising. The sponsor may be encouraging you to commit quickly. You may feel excitement about the projected returns. This is precisely when you must…

-

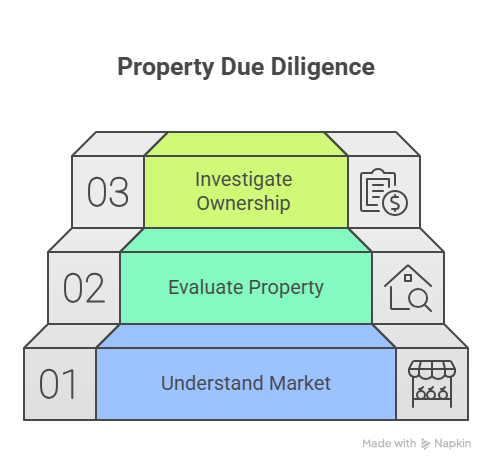

#76 Beyond the Sponsor: Analyzing the Property That Will Generate Your Passive Income

—

by

You have identified sponsors you trust [1] and refined your investment thesis to filter opportunities that align with your goals [2]. Now comes a critical juncture: evaluating the specific property that will house your capital for the next five to seven years. While your sponsor vetting process has eliminated the majority of deals crossing your…

-

#75 Book Review – Who Not How

—

by

Why the most successful investors ask “Who?” instead of “How?” When most of us encounter a problem or set a goal, our first instinct is to ask: “How can I accomplish this?” According to Dan Sullivan and Benjamin Hardy in their book “Who Not How” [1] this question, while natural, fundamentally limits our potential for…

-

#74 Different Types of Syndication Deals

—

by

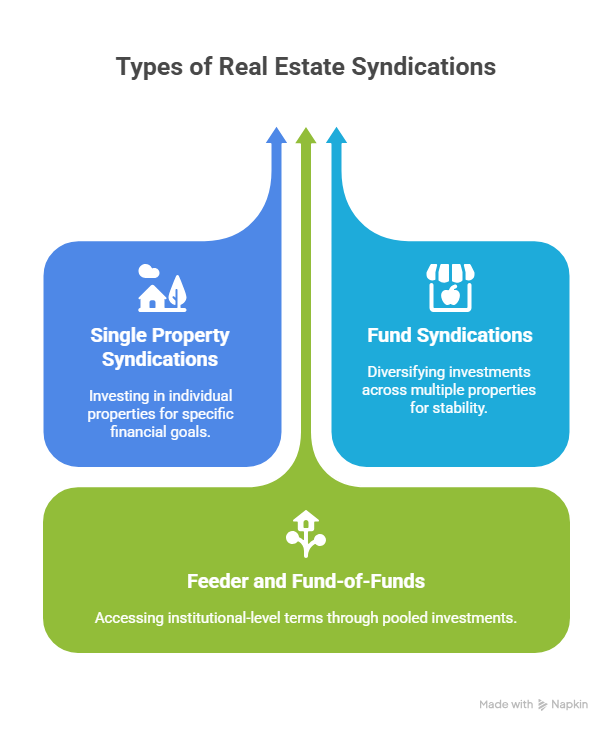

Investors entering the syndication space often assume all deals follow the same basic structure: a group pools money to buy a single, identified property. While this represents the most common opportunity you will encounter, limiting yourself to this single approach can restrict your ability to build truly diversified passive income streams. Understanding the three distinct…

-

#73 Understanding the Capital Stack and How It Impacts Your Returns

—

by

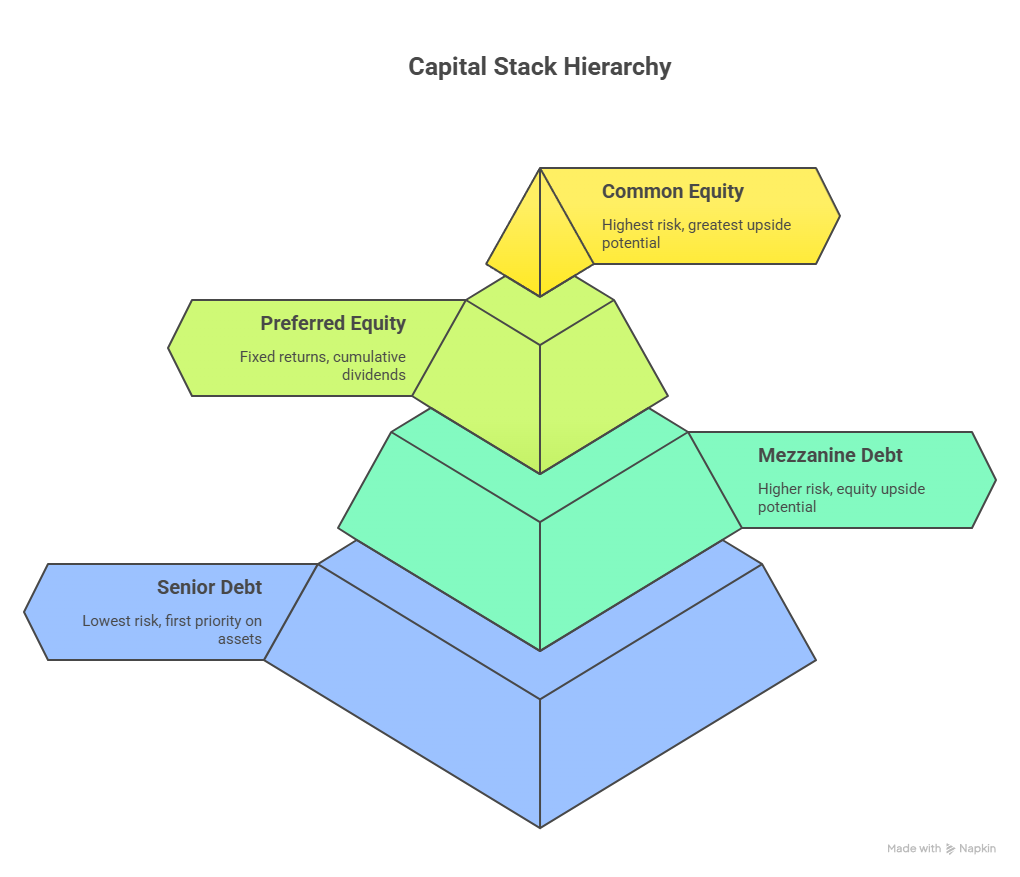

When evaluating real estate investment opportunities, most investors focus primarily on location, asset class, and projected returns. While these factors are undeniably important, there is another critical element that can dramatically impact your investment outcomes: the capital stack. Understanding how a deal is financed and structured can mean the difference between achieving your expected returns…

-

#72 Vetting a Syndication Sponsor

—

by

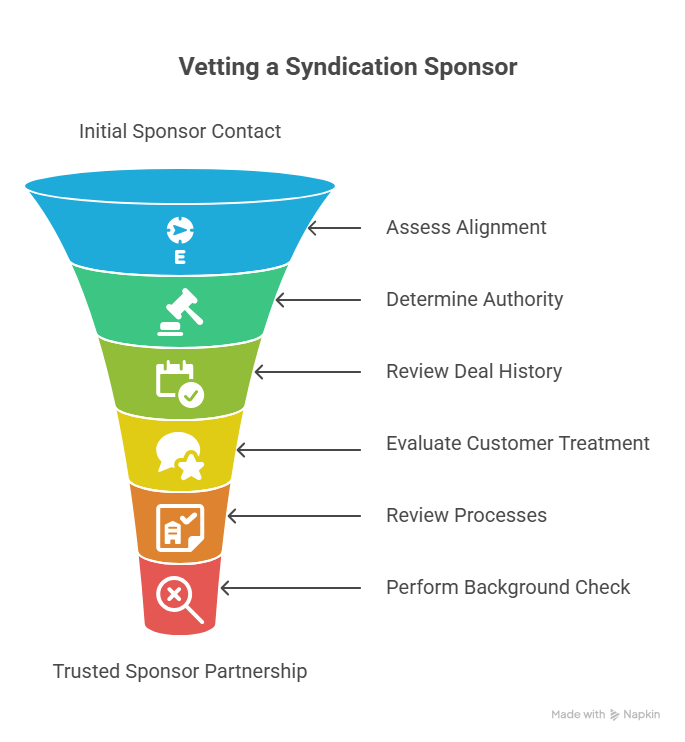

The most critical due diligence step for any passive investor involves thoroughly vetting the sponsor and team who will manage your investment. This principle cannot be overstated: an exceptional sponsor can transform a mediocre deal into a profitable venture, while an incompetent sponsor can destroy even the most promising opportunity. Your success depends entirely on…

-

#71 How I Eliminate Deals That Don’t Work in Minutes

—

by

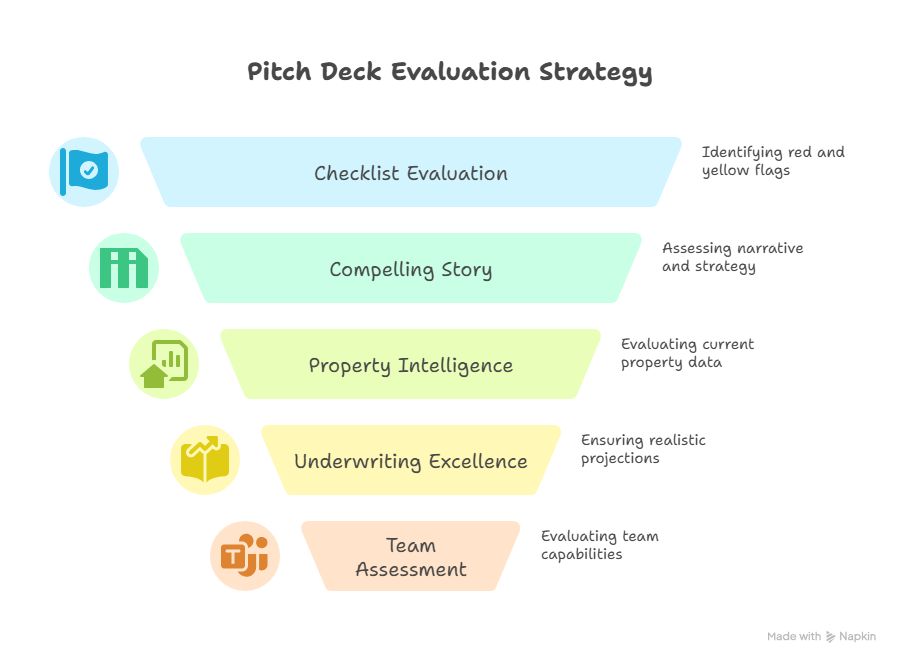

As your syndication portfolio grows, you will face a new challenge: too many opportunities and not enough time to evaluate them all. This abundance of options represents a significant shift in your investment journey. Where you once searched desperately for any deal, you now must become selective, strategic, and efficient in your evaluation process. The…

-

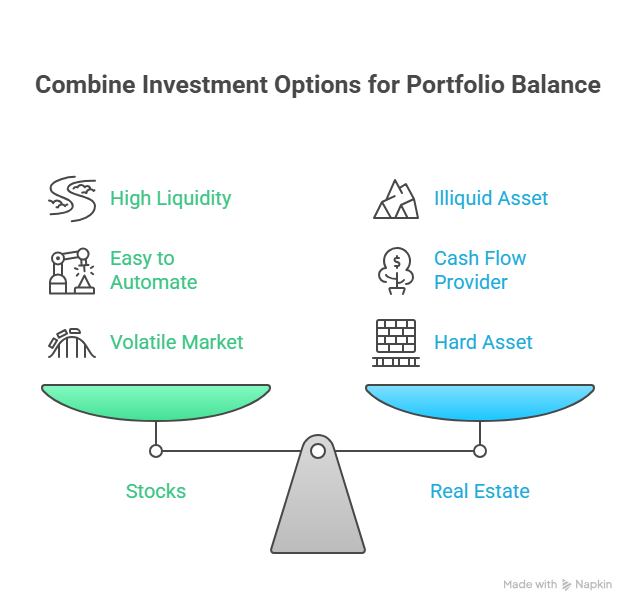

#70 Balancing Stocks and Real Estate in Your Portfolio

—

by

If you spend time in real estate investing circles, you will encounter a curious phenomenon: many seasoned real estate investors entirely dismiss stock market investing. Syndicators, in particular, seem to share a universal set of complaints about traditional securities:: These criticisms contain elements of truth, but they present an incomplete picture while ignoring the compelling…