If you spend enough time around real estate investors and ask enough questions, eventually the topic of depreciation recapture emerges. This is a subject you need to understand if you want to avoid an unpleasant surprise when your deal closes and the tax bill arrives.

As you likely know, one of the significant advantages of real estate investing is the ability to deduct depreciation on investment property. This paper loss can often make a cash-flowing property appear to lose money when you file your tax returns. At minimum, it reduces the taxable income the property generates. This represents a powerful benefit of real estate investing and is frequently cited by those who argue that real estate offers superior tax advantages compared to stock market investing.

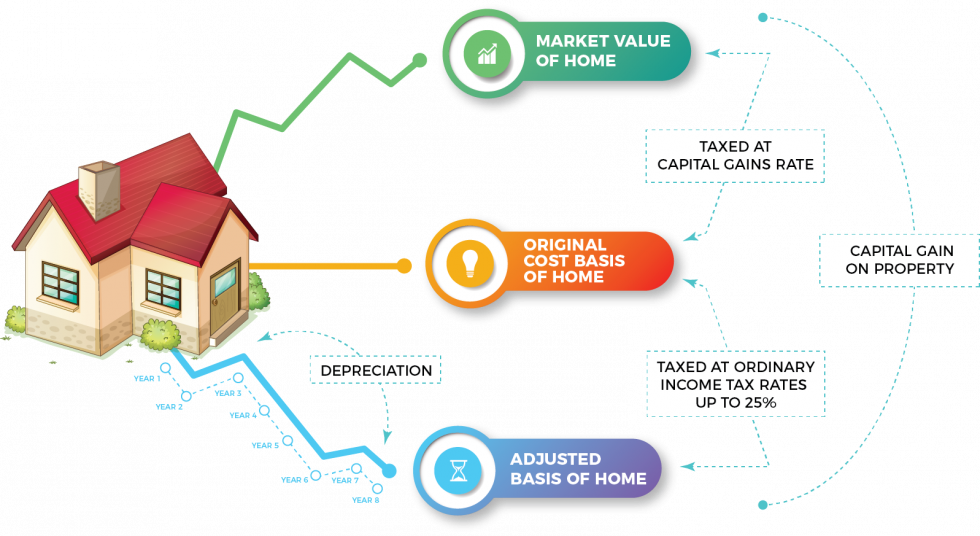

However, what often gets overlooked in those conversations is a critical detail: you must pay taxes on that depreciation when you sell the property. At sale, the depreciation you have taken against the property is calculated based on your tax history for that investment. This portion of your gains is not treated as capital gains and is taxed at rates you might not expect.

The addition of depreciation recapture to your tax bill can deliver an unpleasant shock, particularly when your deals included cost segregation studies and bonus depreciation. Understanding how recapture is calculated, what steps can offset it, and how to prepare when facing it for the first time is worth your time. Before we start, however, this seems like a good opportunity to remind you that I am not a tax professional. You should work with your own CPA and tax advisors before making any decisions based on this information.

Calculating Depreciation for Recapture

The amount of depreciation you need to recapture is the total depreciation you have taken, or could have taken, on the property during your ownership period. If you completed a cost segregation study on the property, that would have accelerated your depreciation by breaking the building into its 5-year, 10-year, and 15-year components (known as personal property, even on commercial buildings). Depending on when you purchased the property, you may have also utilized bonus depreciation to increase your first-year deduction. Finally, at least some portion of the property would have received straight-line depreciation for the core structural elements of the building. Knowing each of these components gives you the starting point for calculating what you need to recapture.

Notice the phrase “could have taken.” This distinction matters. The IRS does not require you to claim depreciation as a deduction. However, failing to do so means you are calculating your taxes incorrectly in the IRS’s view. As a result, the IRS requires you to pay recapture on the amount you could have claimed if you had filed your taxes properly. Since not claiming depreciation does not reduce the recapture amount you will owe, if you have not been taking depreciation in previous years, have your accountant adjust your return the next time you file to include it. This adjustment is straightforward, and even if it does not reduce your current tax liability, it will impact what you owe when you sell the property.

Cost Segregations and Fully Depreciated Assets

One benefit of combining a long holding period with cost segregation is that your accountant can assign a current market value to the personal property components as part of your final accounting at sale. For example, if your carpet was originally valued at $10,000 and was never replaced even though you held the building for seven years, your accountant may assess its current value at $1,000 or even $0. They must be able to justify this valuation, but a reduction here is important because it directly affects your tax rates.

Tax Rate on Recapture

Recapture on personal property is taxed at your ordinary income tax rate. Since you are selling a property and presumably recognizing a significant profit, this rate is likely at least 32% and may reach 37%. However, depreciation recapture on the building itself (known as Section 1250 property) is taxed at your ordinary income rate up to a maximum of 25%. This means you could save as much as 12% of the depreciation you have taken by maximizing the portion allocated to the building rather than personal property.

A Concrete Example

Consider a concrete example to illustrate these concepts with actual numbers. You purchase a property for $1 million. At acquisition, $250,000 is allocated to land (which cannot be depreciated), and you commission a cost segregation study that partitions the remaining $750,000 into the following categories:

- $500,000 allocated to the building (Section 1250 property)

- $75,000 allocated to 15-year property

- $100,000 allocated to 10-year property

- $75,000 allocated to 5-year property

You hold the property for five years, make no significant improvements, and sell it for $1.5 million. Your accountant determines that the original 5-year personal property, which has reached the end of its useful life and was not replaced, now has $0 in remaining value. The 10-year and 15-year property categories, however, have maintained their value at $175,000 combined because these components (such as parking lot improvements or HVAC systems) remain functional and valuable.

In the first year, because you were eligible for 100% bonus depreciation, you claimed $250,000 in depreciation for all the personal property categories. Over the course of your five-year ownership, you also claimed approximately $91,000 in depreciation against the building itself (straight-line Section 1250 depreciation). This calculation puts your adjusted basis at the end of five years at $659,000 ($1M – $250k in personal property depreciation – $91k in building depreciation).

Based on the sales price of $1.5 million, your total gain on the property is $841,000. Congratulations on a successful investment!

Now you must calculate how much tax you owe on this gain.

You can reasonably assume that the land appreciated proportionally with the rest of the property, valuing it at approximately $400,000 at sale. The additional $150,000 in land appreciation is taxed as long-term capital gains.

Your 5-year property is valued at $0 according to your accountant’s assessment. However, your 10-year and 15-year property components have not changed in value and are still appraised at $175,000 combined. Since your tax basis in these components is $0 (you claimed all the depreciation in year one through bonus depreciation), you owe taxes on the full $175,000 of recapture.

The value attributed to the building is the remaining difference between your sale price and the other allocated components. In this case, that is $925,000 ($1.5M – $400k for land – $175k for personal property). The taxable amount consists of the $91k of depreciation recapture on the building (taxed at a maximum of 25%) plus the $425,000 profit taxed as long-term capital gains.

That means that your expected tax liability would be about $200k or just under 25% of your gain. That’s a lot of money, and you can see why this would be an unpleasant surprise for someone who thinks they are able to keep a lot more than actually can.

Use Existing Passive Losses

If you are like most high-income earners who are not real estate professionals, you have carried forward passive losses from previous years. That is good news.

In general, you will be able to use the passive losses you have accumulated to offset these recapture taxes.

Continuing our example, assume that while you held the property, you were unable to use $175,000 of depreciation to offset your active income because of passive activity loss limitations. In this case, you would have a passive activity loss carry-forward of $175,000 on your previous year’s tax return. This amount can be applied to offset the gains associated with the sale of the property.

The IRS allows you to apply these losses against your highest-taxed income first. In this scenario, that means you would be able to fully offset the taxes on your $175,000 of personal property recapture. This would reduce your tax liability by approximately $65,000. While you would still face a tax bill of approximately $135,000, that represents significant savings.

Creating New Losses

While no one enjoys a substantial tax bill, it signals that you are generating significant profits, which is the goal. That said, there are potential strategies for reducing your tax liability further if you plan appropriately. I will briefly discuss three approaches here, each with important considerations about how they align with the passive investing.

The Short-Term Rental Strategy

Assuming you meet certain requirements, short-term rentals (STRs) are considered active businesses for tax purposes. This classification means that losses in your STR business can be used to offset any income, including capital gains and ordinary income. This represents a powerful strategy because an STR business can often claim bonus depreciation on the property, creating substantial first-year losses that offset other income.

However, this strategy comes with the important caveat that operating a short-term rental is not passive. You must materially participate in the business, which the IRS generally defines as spending more than 100 hours per year on the activity (with no one else spending more time than you do). While you can hire a property management company to handle day-to-day operations, you still need to make management decisions, oversee the business, and invest time in its success.

This approach makes sense if you have always wanted to own a vacation rental property and are willing to treat it as an active business venture. However, you should consider this strategy only if you genuinely want to operate a hospitality business as part of your investment portfolio, not solely for the tax benefits.

Real Estate Professional Status

This option is frequently mentioned as a way to reduce taxes because, similar to STRs, you can use real estate depreciation to offset your active income. However, this strategy is extremely challenging to achieve and fundamentally incompatible with maintaining your high-income career.

To qualify as a real estate professional, you must meet two requirements: you must spend more than 750 hours per year in real estate trades or businesses, and more than half of your working time must be spent in real estate activities. For someone maintaining a normal job, this is virtually impossible. Additionally, if you claim real estate professional status, you are likely to face IRS scrutiny and potential audit. You must maintain detailed documentation of your time and activities to support your claim.

Oil and Gas Investing

If you have recently received a large sum of money from selling a property, you will likely want to reinvest it in other cash-flow-generating investments. While the risks of oil and gas investments cannot be overstated, you may be able to deduct a substantial portion of your investment against your taxes immediately through intangible drilling costs.

The tax benefits can be compelling: you might deduct 70% to 85% of your investment in the year you make it. This does not guarantee investment success, but the tax advantages help mitigate risk by reducing your effective cost basis. In some cases, using these deductions to offset a large recapture tax bill can be more financially beneficial than simply paying the IRS.

Consider this option only if you understand and accept these risks, and if the investment aligns with your overall portfolio strategy beyond just the immediate tax benefits..

The Key to Managing Recapture

The common thread across all these strategies is the importance of advance planning. Depreciation recapture does not need to catch you by surprise. When you purchase an investment property, particularly one where you plan to use cost segregation and bonus depreciation, you should already be thinking about the eventual sale and the tax implications.

Work with your CPA to project the potential recapture liability based on your depreciation schedule. Factor this into your investment returns analysis from the beginning. If you are investing in a syndication, ask the sponsor how they plan to handle recapture at sale and whether they have strategies to minimize the impact on investors.

Summary

Depreciation recapture catches many investors by surprise. While most people understand they will owe taxes when selling a property for a profit, they often underestimate the specific implications of recapture on their tax liability. The combination of personal property recapture taxed at ordinary income rates and Section 1250 recapture can dramatically impact the net proceeds you receive from a sale.

The key to managing recapture effectively is understanding it from the beginning, planning for it throughout your holding period, and working with qualified tax professionals to minimize its impact through legitimate strategies. Passive loss carry-forwards from previous years can substantially reduce your recapture liability, which is one reason why the annual passive losses that frustrate many investors during the holding period can provide significant value at sale.

While strategies exist to create additional losses that offset recapture, evaluate these carefully to ensure they align with your overall investment philosophy and goals. Not every tax strategy makes sense for every investor, particularly when it conflicts with the objective of building truly passive income streams that do not consume your time and attention.

Ultimately, depreciation recapture is the cost of having received valuable tax benefits during your ownership period. Plan for it appropriately, use available strategies to minimize its impact, and remember that owing recapture taxes means your investment generated the profits you sought. That is ultimately a problem worth having.

PS: Are you an adventurer at heart? Always wanted to hang out with thousands of penguins in their natural environment and visit the frozen continent? Join me and a small group of real estate investors for an exclusive workshop aboard an expedition cruise to Antarctica in February 2027. Build lifelong relationships while exploring one of Earth’s last pristine wildernesses. To learn more and reserve your cabin go to https://www.mbc-rei.com/2027 Have questions? Email me at events@mbc-rei.com.

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.