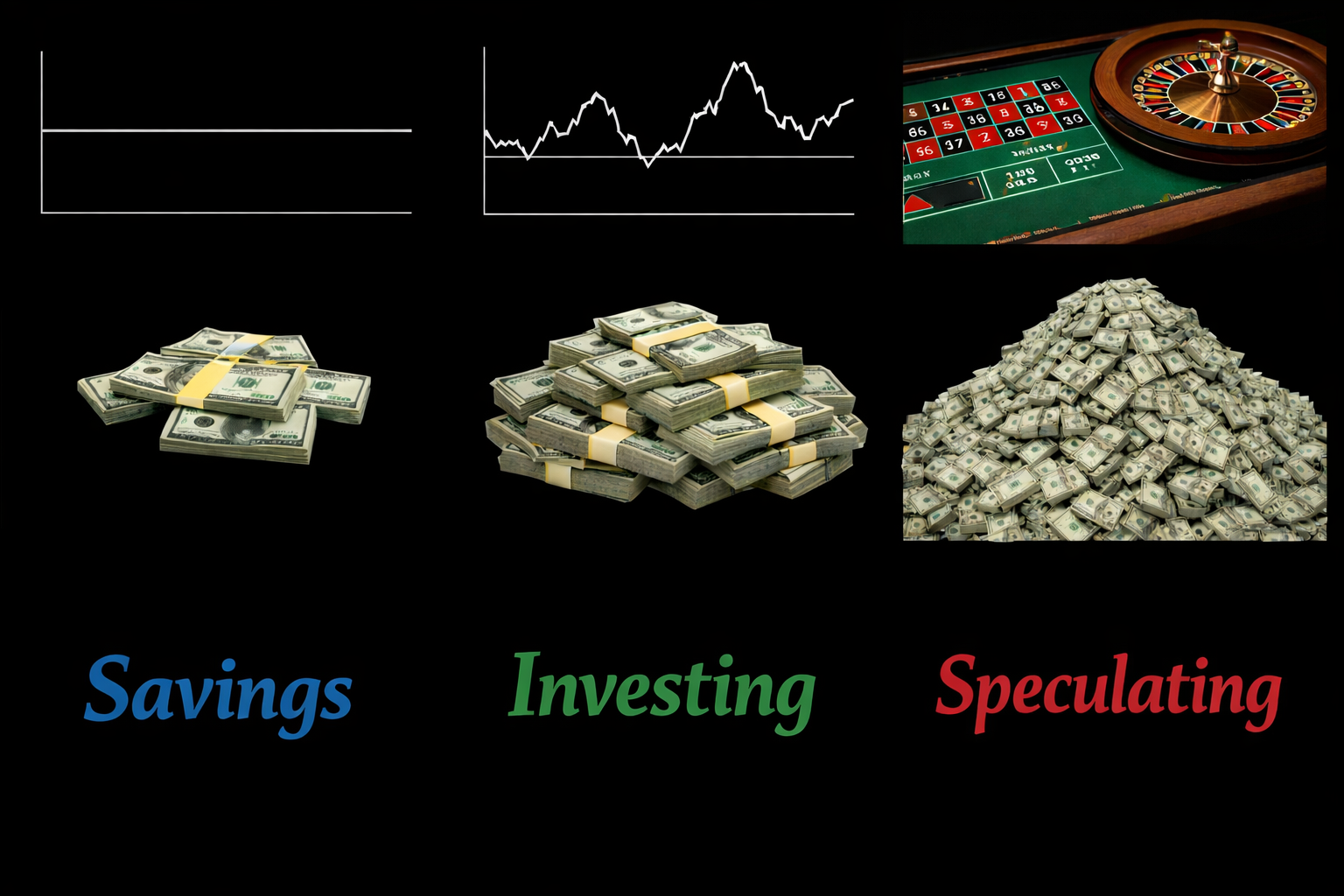

People often use the terms saving and investing interchangeably. This creates real problems. When you treat fundamentally different concepts as the same thing, you make decisions based on faulty assumptions about risk, return, and control. Understanding the distinctions between saving, investing, and speculating is not academic. It is the foundation for building a portfolio that serves your financial goals rather than undermining them.

Saving: Preserving Capital

Saving means putting money into opportunities with an extremely low chance that your initial capital will not be returned. Traditional savings vehicles include bank savings accounts, money market accounts, and Treasury bills. The defining characteristic is capital preservation. You should expect to receive your original investment back, adjusted only for the modest interest earned.

The trade-off is that minimal risk yields minimal returns. Savings rates rarely keep pace with inflation. Your nominal balance may grow, but your purchasing power often declines. This erosion happens slowly, almost imperceptibly, which makes it easy to ignore.

Financial professionals sometimes call the return on savings the “risk-free rate,” though this terminology is misleading. Even the safest savings vehicles carry inflation risk and opportunity cost. The label persists because the probability of losing your nominal principal is vanishingly small.

Saving serves critical functions in a complete financial strategy. Emergency funds require capital preservation above all else. Short-term goals with specific timelines demand predictability. But saving alone cannot build wealth or generate the cash flow necessary to break paycheck dependency.

Investing: Accepting Risk for Return

Investing involves putting capital into opportunities where you face genuine risk of loss in exchange for the potential of meaningful returns. The investment universe spans an enormous range: publicly traded stocks, private equity, secured and unsecured loans, commercial and residential real estate, commodities, and venture capital, among others.

These opportunities share no single common characteristic beyond one: you might lose money. Investments can be liquid or illiquid, short-term or long-term, highly volatile or relatively stable. The common thread is risk, and with that risk comes the potential for returns that exceed what saving can provide.

The relationship between risk and return is fundamental to investing. Higher perceived risk demands higher potential returns to compensate investors for bearing that risk. A corporate bond pays more than a Treasury bill because the corporation might default. A startup investment offers the possibility of extraordinary returns precisely because most startups fail.

Understanding the risk-return relationship prevents two common mistakes. First, chasing unusually high returns without acknowledging the corresponding risk. If an opportunity promises returns far above comparable investments, investigate why. Either the investment carries risks you have not identified, or you have discovered a genuinely mispriced opportunity, which is rare. Second, avoiding all investments because they carry risk. While saving preserves capital, it cannot generate the returns necessary to achieve financial independence within a reasonable timeframe.

Speculating: Hoping For the Best

Speculating means putting capital into opportunities you do not fully understand and over which you have no meaningful control. In speculation, you are essentially hoping for favorable outcomes without the knowledge or capability to influence those outcomes.

Gambling represents the purest form of speculation. When you place money on red at the roulette wheel, you have no control over where the ball lands and no skill that improves your odds. You are entirely at the mercy of chance.

However, you can also speculate within most asset classes. Buying individual stocks in industries you do not understand is speculation. Investing in real estate markets you have not researched is speculation. Putting capital into cryptocurrency without having an underlying understanding of its fundamentals, or even knowing how it works, is speculation.

Because speculation carries the highest risk of capital loss, it theoretically offers the highest potential returns when outcomes prove favorable. But this “potential” for high returns means nothing if you lack the knowledge to identify which opportunities have genuine merit and which are likely to fail.

The Critical Difference: Knowledge and Control

The distinction between investing and speculating is not built into the asset class or opportunity itself. It depends on your level of knowledge, skill, and control relative to that opportunity.

Consider poker as an example. For most people, sitting down at a poker table represents pure speculation. You understand the basic rules and can play the game, but your skill is limited. You do not know the mathematical odds of each hand. You cannot read other players effectively. You have no systematic approach to managing your money. Against experienced players, you will lose far more than you win over time.

However, for someone like Annie Duke, a World Series of Poker champion and decision-making expert, the same poker table represents an investment. She possesses deep skill in probability, game theory, and psychology. She can read opponents and adjust her strategy based on observed patterns. While she will not win every hand or even every session, her expertise gives her a sustainable edge. Over time, she generates consistent positive returns.

The asset is identical. The table, the cards, the rules are the same. What transforms speculation into investment is the player’s expertise and control.

This same dynamic appears across all asset classes. Whether putting capital into real estate, stocks, options, loans, or any other vehicle constitutes speculation or investment depends entirely on your knowledge, skills, and degree of control.

Risk-Adjusted Returns and the Value of Expertise

This relationship between expertise and outcomes introduces the concept of risk-adjusted returns. When you possess genuine expertise, you can identify and reduce specific risks that others cannot. This risk reduction increases your expected return for a given level of nominal risk.

Warren Buffett’s long-term outperformance of the S&P 500 demonstrates this principle. Buffett had access to the same investment opportunities as other investors, particularly early in his career. He did not possess inside information or unique deal flow that others lacked. What separated his returns from average market returns was his ability to evaluate businesses, identify lasting competitive advantages, understand management quality, and assess intrinsic value. This expertise allowed him to avoid poor investments and to size positions appropriately based on his conviction level.

Buffett invested where others speculated because his expertise transformed the risk profile of each opportunity. He could identify situations where the market price reflected excessive pessimism or optimism, and he could hold positions through volatility that shook out less informed investors.

This explains why experts can generate superior returns across any asset class. The returns do not come from secret opportunities or insider access. They come from the ability to accurately assess risk, avoid costly mistakes, and maintain discipline when others panic or become greedy.

The Danger of Overestimating Your Expertise

The most difficult aspect of distinguishing between speculation and investment is honestly assessing what advantage, if any, your expertise provides. People systematically overestimate their knowledge and abilities. We mistake familiarity for expertise, confidence for competence, and lucky outcomes for skillful execution.

This overconfidence creates a trap: when you overestimate your advantage, you underestimate the risk you face. You believe you are investing when you are actually speculating. You size positions as if you have an edge when you do not. You take risks that are inappropriate for your actual level of knowledge and control.

The recent experience of many multifamily real estate investors illustrates this trap. As interest rates remained low for over a decade, numerous investors entered the multifamily space. Deal volume increased. Competition intensified. Investors who previously focused on other strategies shifted capital into multifamily properties.

Many of these investors believed their general real estate knowledge transferred directly to multifamily investing. They understood concepts like capitalization rates, net operating income, and debt service coverage ratios. They could underwrite a deal and build a financial model. This familiarity created confidence. However, when interest rates rose sharply, a disturbing pattern emerged. Properties that appeared stable entered distress. Investors who seemed competent faced foreclosure. Deals that penciled at acquisition failed to perform.

Truly skilled multifamily investors like Ken McElroy navigated this environment successfully. They had developed expertise through multiple market cycles. They understood not just the mechanics of multifamily investing but the underlying market dynamics, the importance of conservative underwriting, and the necessity of maintaining adequate reserves. When conditions changed, their expertise allowed them to adapt.

Investors who overestimated their expertise suffered a different fate. They possessed knowledge sufficient to participate in the market but insufficient to manage through adversity. They could execute deals in favorable conditions but lacked the depth of understanding necessary to anticipate and weather difficult periods. They believed they were investing. They were speculating.

The painful lesson is clear: expertise is not binary. You can know enough to be dangerous without knowing enough to be successful. The challenge is recognizing where you actually stand on that spectrum.

Assessing Your Own Position

Before putting capital into any opportunity, pause and answer these questions honestly:

On Knowledge:

- Can you explain how this investment generates returns in terms your parents or children would understand?

- Do you understand what could cause this investment to lose money and the probability of each risk?

- Have you invested time studying this asset class, or are you relying on surface-level understanding?

- If this investment performs poorly, will you know why?

On Control:

- What decisions can you make that will directly influence this investment’s outcome?

- If conditions change, what actions can you take to protect your capital or improve results?

- Are you dependent on others’ expertise, or do you possess the knowledge to evaluate their decisions?

On Track Record:

- Have you successfully navigated this asset class through different market conditions?

- Do you have a systematic approach?

- When you have succeeded previously do you know the specific factors that drove that success?

- When you have failed, did you understand why at the time or only in retrospect?

If you cannot answer most of these questions, you are likely speculating rather than investing. Speculation has a place in a complete portfolio, provided you acknowledge it and size your positions appropriately. The question is whether you recognize this reality and act accordingly.

The danger comes from believing you are investing when you are not, from risking capital you cannot afford to lose on outcomes you cannot meaningfully influence.

The path from speculation to investment requires time, study, and experience. It demands honest self-assessment and a willingness to admit what you do not know. But making this transition is precisely what allows certain people to make outsized returns on opportunities available to everyone.

PS: Are you an adventurer at heart? Always wanted to hang out with thousands of penguins in their natural environment and visit the frozen continent? Join me and a small group of real estate investors for an exclusive workshop aboard an expedition cruise to Antarctica in February 2027. Build lifelong relationships while exploring one of Earth’s last pristine wildernesses. To learn more and reserve your cabin go to https://www.mbc-rei.com/2027 Have questions? Email me at events@mbc-rei.com.

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.