Last week I was talking to someone who is struggling to get started in syndications. Conceptually, they understand the attraction of getting cash flow from an investment while that investment continues to appreciate in value. But they are having a hard time making a decision on what to invest in. They asked the question: “If you were just getting started now, based on what you know, what would you do?”

It took me a few minutes to really think through my answer.

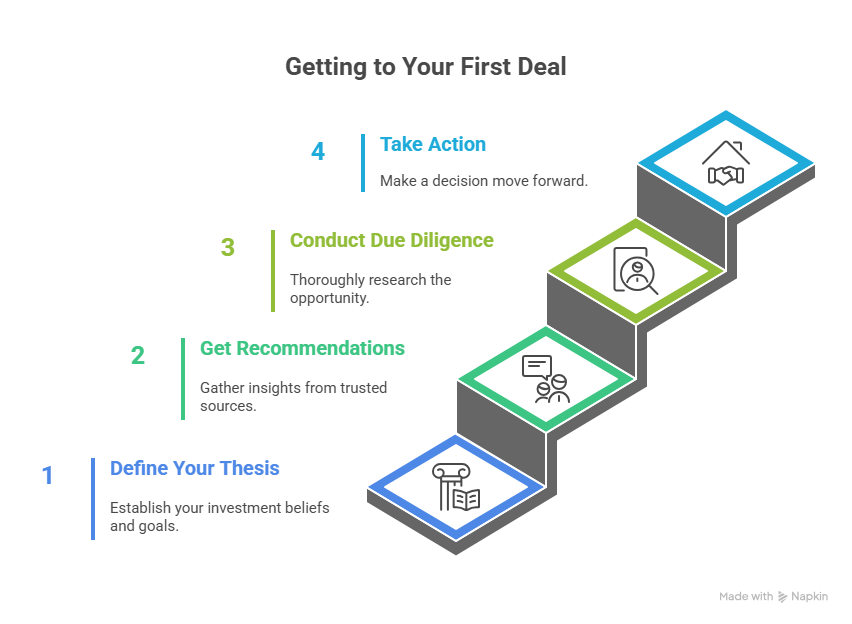

Ultimately, I identified four essential steps that represent the most direct path from interested observer to active investor. These steps are not complicated, but they are sequential. Each builds on the previous one, creating a framework that transforms abstract interest into concrete investment decisions. More importantly, this framework addresses the paralysis that many high-income professionals experience when first encountering syndication opportunities.

Step 1: Get Clear on Your Investment Philosophy

One of the most important, but also hardest, decisions to make is to really understand your investment philosophy. Everyone wants an investment that will return substantial cash flow returns while appreciating significantly, with minimal risk and substantial tax benefits. That investment does not exist. You need to understand what tradeoffs make sense for you, since every investment requires you to make tradeoffs from that ideal.

Your investment philosophy answers fundamental questions about what you are trying to accomplish. Are you looking for cash flow to replace your income? Appreciation to build up your net worth? Tax benefits to offset your high W-2 earnings? How much risk are you willing to accept in pursuit of those objectives? How long can you leave capital deployed without needing access to it?

These questions matter because they determine which opportunities deserve your attention and which you can safely ignore. Without clarity on your philosophy, you will find yourself endlessly evaluating deals that may be excellent investments for someone else but entirely wrong for you. This wastes your time while preventing you from moving forward on opportunities that do align with your goals.

Understanding your investment thesis [1, 2, 3] lets you understand what deals are worth your time to examine closely. As importantly, it tells you what deals you can dismiss quickly since they fall outside your area of interest. This filtering function becomes increasingly valuable as you build your network and encounter more opportunities.

Consider the practical difference this clarity creates. An investor focused on generating immediate cash flow to offset living expenses will evaluate deals entirely differently than an investor focused on appreciation and wealth building. The first investor may prioritize stable, cash-flowing mobile home parks in secondary markets. The second may target development opportunities in growing markets where current cash flow is minimal but appreciation potential is substantial. Both strategies can be excellent. Neither is right for the both investors.

While determining your investment thesis is not a one-time activity, revisiting it annually or biannually should be sufficient for most investors. Your philosophy will evolve as your circumstances change, but it should remain stable enough to guide consistent decision-making over extended periods. Frequent changes to your core philosophy often indicate insufficient initial clarity rather than genuine evolution of your objectives.

Step 2: Ask Your Network For Recommendations

If you know people who have invested in syndication deals already, talk to them about their experience. What led them to the deals they invested in? How are the deals performing? Do they have sponsors they would recommend for deals that fit your investment thesis?

The syndication investment community is relatively small and interconnected. Most people who have been investing for a few years know many of the major sponsors—or at least know someone who knows them. Good sponsors develop positive reputations over time through consistent execution and transparent communication. Poor sponsors develop different reputations, though these often circulate more quietly through private conversations.

This network effect creates is a great resource for new investors. Getting recommendations for investments that fit your thesis from someone you trust provides a starting point that is far more efficient than attempting to evaluate every opportunity you encounter. Your network acts as an initial filter, directing your attention toward sponsors who have demonstrated capability with investors you know personally.

When having these conversations, ask specific questions that go beyond surface-level satisfaction. How does the sponsor communicate during challenging periods? Have there been any surprises—positive or negative—during the hold period? Would they invest with this sponsor again? Have they introduced friends or family to these opportunities? The answers to these questions reveal far more than promotional materials ever could.

It is worth noting that readers of this material already have at least one connection to the syndication investment world: you know me through these writings. While I do not operate as a syndicator, I maintain relationships throughout the industry and can often point investors toward sponsors whose approach and track record align with particular investment philosophies. This is one practical benefit of engaging with educational content before you need it. You build relationships and knowledge that prove valuable when you are ready to act.

Your network also provides a natural mechanism for ongoing learning. As you speak with other investors, you encounter different perspectives on risk, different approaches to due diligence, and different experiences that inform your own decision-making. This collective wisdom helps you avoid common mistakes and identify considerations you might otherwise overlook.

However, understand that recommendations represent starting points, not endpoints. A sponsor who has performed excellently for one investor may not align with your particular goals or risk tolerance. Personal chemistry matters in these relationships as well. You will be partnering with this sponsor for years, receiving regular communications, and entrusting them with substantial capital. The relationship must work for you specifically, regardless of how well it has worked for others.

Step 3: Do Due Diligence

A recommendation alone, however, is not sufficient to invest. You need to spend the time to do your own due diligence on the sponsor. You can start simply, with a quick check on InvestClearly [4], but you also want to make sure that you spend the time to investigate the sponsor yourself as well as the specific deal you are considering [5, 6, 7].

This step is critical to understanding and mitigating the risk that you are taking. Due diligence serves as your primary defense against the real dangers that exist in this space: not just poor performers or inexperienced operators, but genuine fraud. I have friends who invested in two different Ponzi schemes. I nearly invested in one myself. These are not theoretical risks. They are real situations that have cost investors their entire investments.

Your due diligence process should be systematic and thorough. Begin with the sponsor’s track record. How many deals have they completed? What asset classes do they focus on? How have those investments performed relative to initial projections? Understand that some deviation from projections is normal and expected. No sponsor hits their numbers perfectly on every deal. However, patterns of significant underperformance or consistent optimism that reality fails to match should raise concerns.

Examine the sponsor’s role in the deal structure. Review the sponsor’s financial position and liquidity. They should have sufficient resources to address unexpected expenses without jeopardizing the investment. Equally important, understand how much of their own capital they are investing beyond management fees.

Evaluate the specific property and market. Does the business plan make sense given current market conditions? Are the renovation budgets realistic? Do the comparable properties support the projected rent levels? Have population and employment trends been stable or growing? What are the natural disaster risks, and has the sponsor accounted for appropriate insurance and reserves?

At this point, you should also seriously consider paying for professional due diligence services and engaging a lawyer to review the specific legal documents for the deal. This represents a potentially significant additional cost. While this expense may feel substantial relative to your first investment, it represents a small percentage of the capital you are deploying and provides protection against catastrophic loss. It also helps you learn more about what you should be looking for when doing your due diligence.

I recognize that some investors choose not to engage these professional services, particularly on their first deal. This is an understandable decision, but it is important to acknowledge that skipping professional review increases your risk. You are relying entirely on your own analysis and the sponsor’s disclosures, without the benefit of experienced professionals who may identify concerns you would miss. This may be an acceptable tradeoff depending on your circumstances, but it should be a conscious decision rather than an oversight.

Your investment of time and money in due diligence serves a critical purpose beyond risk mitigation. It builds your confidence in the investments you ultimately make. When you have done the work to understand what you are investing in and why, you can hold that investment without second-guessing your decision. This confidence proves invaluable during the multi-year hold period typical of syndication investments.

Step 4: Take Action

Once you have completed your due diligence, the natural tendency is to continue evaluating options and thinking through different scenarios. While that is beneficial to a point, it eventually becomes a form of procrastination. Ultimately, you have to take action: sign the documents and wire the money.

This final step proves surprisingly difficult. You have worked hard for your capital. The amounts involved in syndication investments represent substantial resources. Wiring that money to a sponsor you may have only spoken with a few times feels uncomfortable. It will be uncomfortable the first time you do it. It is still uncomfortable to me after more than a dozen deals.

That discomfort reflects the genuine risk you are accepting. Syndication investments are illiquid, long-term commitments with real potential for loss. It indicates you understand what you are doing and take it seriously. The goal is not to eliminate that discomfort but to act despite it, after you have done the work to understand and mitigate the risks involved.

Perfect certainty will never arrive. You will always be able to identify additional questions to research, additional scenarios to consider, additional deals to evaluate for comparison. At some point, continued analysis provides diminishing returns while preventing you from making progress toward your actual goal—breaking your paycheck dependency through passive income generation.

This is where your investment philosophy from Step One proves its value. If you have clarity on what you are trying to accomplish and have found a deal that aligns with those objectives, and you have completed thorough due diligence on both the sponsor and the opportunity, then you have the information necessary to make an informed decision. Additional analysis at that point serves anxiety rather than wisdom.

Taking action also creates momentum that proves valuable beyond the specific deal. Your first investment transforms you from interested observer to active participant. You begin receiving investor communications, experiencing how sponsors operate during the hold period, and building practical knowledge that improves your ability to evaluate future opportunities. This learning cannot happen until you actually invest.

Understand that taking action does not mean rushing into unsuitable deals. It means completing your process thoroughly and then making decisions based on the information you have gathered rather than indefinitely seeking additional certainty. Unless you take this last step, you will not be any closer to achieving financial freedom than you were when you started reading about syndications.

Moving Forward

These four steps – clarifying your philosophy, leveraging your network, conducting due diligence, and taking action – provide a framework for transforming your interest in syndication investing into actual investments.

The sequence matters. Attempting to evaluate specific deals before clarifying your investment philosophy leads to decision paralysis and wasted time. Skipping due diligence to accelerate action exposes you to unnecessary risk. Completing due diligence but never taking action leaves you permanently on the sidelines, watching others build the passive income you desire but never experiencing it yourself.

For new investors, completing this cycle once represents the most significant challenge. The first deal requires building confidence in the entire process while accepting real financial risk. Each subsequent investment becomes somewhat easier as you develop relationships with sponsors, refine your due diligence approach, and gain practical experience with how syndications operate during the hold period.

The goal is not to find perfect investments. Perfect investments do not exist, and pursuing them prevents progress. The goal is to find suitable investments that align with your philosophy, come from operators you trust, and move you meaningfully closer to your objective of reducing paycheck dependency through passive income generation. These investments exist, and the framework outlined in this chapter provides a practical path to identifying them and acting with confidence.

For additional reading, see:

- https://www.mbc-rei.com/blog/61-establishing-your-investment-thesis-part-1-define-your-goal/

- https://www.mbc-rei.com/blog/62-establishing-your-investment-thesis-part-2-clarify-your-strategy/

- https://www.mbc-rei.com/blog/63-establishing-your-investment-thesis-part-3-determine-your-tactics/

- https://investclearly.com/

- https://www.mbc-rei.com/blog/72-vetting-a-syndication-sponsor/

- https://www.mbc-rei.com/blog/76-beyond-the-sponsor-analyzing-the-property-that-will-generate-your-passive-income/

- https://www.mbc-rei.com/blog/77-due-diligence-evaluating-the-deal-itself/

Join me and a small, select group of real estate investors for an exclusive workshop aboard an expedition cruise to Antarctica this February. Build lifelong relationships while exploring one of Earth’s last pristine wildernesses. Learn more at https://www.mbc-rei.com/trips-2027-antarctica/

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.