You have identified sponsors you trust [1] and refined your investment thesis to filter opportunities that align with your goals [2]. Now comes a critical juncture: evaluating the specific property that will house your capital for the next five to seven years. While your sponsor vetting process has eliminated the majority of deals crossing your desk, the remaining opportunities still require your analytical attention.

Even the most reputable sponsors can present deals that do not align with your risk tolerance or investment objectives. More importantly, understanding the property-specific risks allows you to make informed decisions and avoid unpleasant surprises during the hold period. This analysis serves a dual purpose: it helps you eliminate unsuitable deals quickly and builds your confidence in the investments you ultimately make.

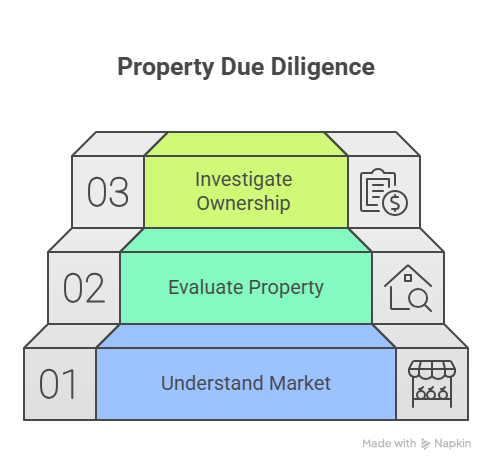

Step 1: Understanding Your Market

The foundation of property analysis begins with market evaluation. Real estate remains fundamentally local, and factors affecting one property may not impact another just blocks away. Your analysis should focus on three key market characteristics that directly influence investment performance.

Natural Disaster and Insurance Implications

Begin by assessing the property’s exposure to natural disasters, starting with flood risk. The Federal Emergency Management Agency maintains detailed flood zone maps [3] that can dramatically impact your investment returns. Properties within designated flood zones face significantly higher insurance premiums, while neighboring properties outside these zones enjoy lower costs. This seemingly minor detail can affect cash flow projections by thousands of dollars annually.

Beyond flood zones, evaluate broader regional risks including earthquakes, wildfires, hurricanes, and severe weather patterns. While you cannot eliminate all natural disaster risk, understanding these exposures allows you to assess whether the sponsor has adequate insurance coverage and realistic reserve projections. Properties in high-risk areas should demonstrate appropriate mitigation strategies and conservative cash flow assumptions.

Demographics and Economic Fundamentals

Your investment success depends on the local population’s ability to support the sponsor’s rent growth projections. Crime statistics provide one data point, but you also want to consider income levels and employment diversity. If the sponsor projects annual rent increases of four percent, the local median income must support such growth without creating affordability issues.

Employment concentration represents a risk factor often overlooked by passive investors. Markets dominated by single employers or industries face heightened volatility during economic downturns. Diversified employment bases provide more stable tenant demand and reduce the risk of sudden occupancy declines.

Population and Competition Trends

Real estate values correlate directly with demand, making population trends essential to your analysis. Growing markets support rent increases and property appreciation, while declining populations create headwinds for both metrics. Examine five to ten-year population trends rather than year-over-year fluctuations, which can mislead due to temporary factors.

Equally important is the competitive landscape. Your property may currently enjoy advantages due to limited competition, but new developments can quickly erode these benefits. Research planned developments, zoning changes, and building permits to understand how the competitive environment may evolve during your investment period.

Step 2: Evaluating Current Property Conditions

Understanding the property’s current state allows you to assess the feasibility and risk of the sponsor’s renovation and repositioning plans. This analysis focuses on four critical areas that directly impact execution timeline and costs.

Property Class and Renovation Scope

The gap between current property class and target positioning determines renovation complexity and cost. Transforming workforce housing into luxury amenities requires comprehensive unit renovations and significant common area improvements such as fitness centers, dog parks, or modern lobbies. These projects demand substantial capital investment and extended timelines.

Conversely, refreshing existing workforce housing while maintaining its market position typically requires less capital and shorter completion timelines. Match the renovation scope with the sponsor’s track record and the market’s ability to support the target rent levels.

Tenant Profile and Transition Planning

Examine whether current tenants align with the sponsor’s target demographic post-renovation. Misalignment requires planning for complete tenant turnover, which affects both timeline and cash flow during the transition period. Understanding this dynamic helps you evaluate the realism of the sponsor’s occupancy and income projections during the renovation phase.

Consider how existing and new tenant bases will interact during renovation periods. Properties targeting significantly different demographics may experience friction during transitions, potentially affecting tenant retention and property reputation.

Lease Structure and Renovation Timing

Current lease terms directly impact renovation scheduling and cash flow during the improvement period. Properties with predominantly annual leases provide more predictable timing for unit improvements but may extend overall project timelines. Month-to-month tenancies offer renovation flexibility but create uncertainty about occupancy levels during construction periods.

This information helps you assess whether the sponsor’s timeline assumptions are realistic and whether their cash flow projections adequately account for potential disruptions during the renovation period.

Competitive Positioning Assessment

Compare the subject property with current market competition to evaluate the sponsor’s rent growth assumptions. If the plan involves bringing below-market rents to current market levels, assess whether the property can realistically compete after renovations. Properties lacking inherent advantages such as superior locations or unique amenities face greater challenges achieving projected rent levels.

High vacancy rates in comparable properties may indicate market softness that could affect your investment’s performance. Ensure the sponsor’s projections account for current market realities rather than relying solely on historical trends.

Step 3: Investigating Current Ownership and Debt Structure

The property’s current ownership and financing structure can reveal important information about potential complications or opportunities in the transaction.

Ownership Due Diligence

While it is unusual, it is not unheard of for the current owner of the property to be the sponsor raising money to “buy” the property. This recapitalization can be a way for the sponsor to hold onto a great property while allowing existing investors to exit if they choose to. However, sponsors should disclose any existing relationships with current owners and explain how the purchase price was determined without typical market pressures.

This transparency protects your interests and ensures the transaction reflects fair market value rather than convenience or relationship-driven pricing.

Debt Analysis and Transaction Complexity

Understanding current property debt levels relative to the purchase price provides insights into transaction complexity and timing. When existing debt exceeds the proposed purchase price, lenders must approve the transaction, potentially extending closing timelines and adding uncertainty.

While sponsors often present these situations as advantageous due to below-market pricing, they typically complicate transactions and may indicate underlying property issues that necessitated the discounted sale.

Recent Sales History

Properties returning to market within three years of the previous sale warrant additional investigation. Quick turnover often indicates that previous owners encountered unexpected challenges or could not execute their business plans successfully. Understanding the reasons for resale helps you assess whether similar risks could affect your investment.

Common factors include unforeseen capital expenditures, regulatory changes, or market shifts that prevented successful repositioning. Determine whether your sponsor faces similar risks or has adequately planned for the challenges that affected previous owners.

Summary

Thorough property due diligence serves two essential purposes in your investment process. First, it enables quick elimination of deals that do not align with your risk tolerance or investment thesis, saving valuable time in your deal evaluation process. Second, it builds confidence in the investments you ultimately make by ensuring you understand and accept the specific risks involved.

Remember that different investors may reach opposite conclusions when presented with identical information, and both can be correct based on their respective investment objectives and risk tolerances. Your goal is not to find perfect deals, but to find deals that align with your investment thesis and risk parameters.

This analytical process also reinforces an abundance mindset essential to successful investing. When you understand that thorough analysis allows you to make informed decisions confidently, you avoid the scarcity thinking that leads to hasty investment choices. There will always be another deal, and passing on opportunities that do not meet your criteria creates space for those that do.

The sponsor should assist with this due diligence by providing comprehensive property information and supporting documentation. However, the responsibility for understanding and accepting the investment risks ultimately rests with you. By conducting this analysis systematically, you transform from a passive capital provider into an informed investor making deliberate choices about your financial future.

For additional reading:

- https://www.mbc-rei.com/blog/72-vetting-a-syndication-sponsor/

- https://www.mbc-rei.com/blog/61-establishing-your-investment-thesis-part-1-define-your-goal/

- https://msc.fema.gov/portal/home

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.