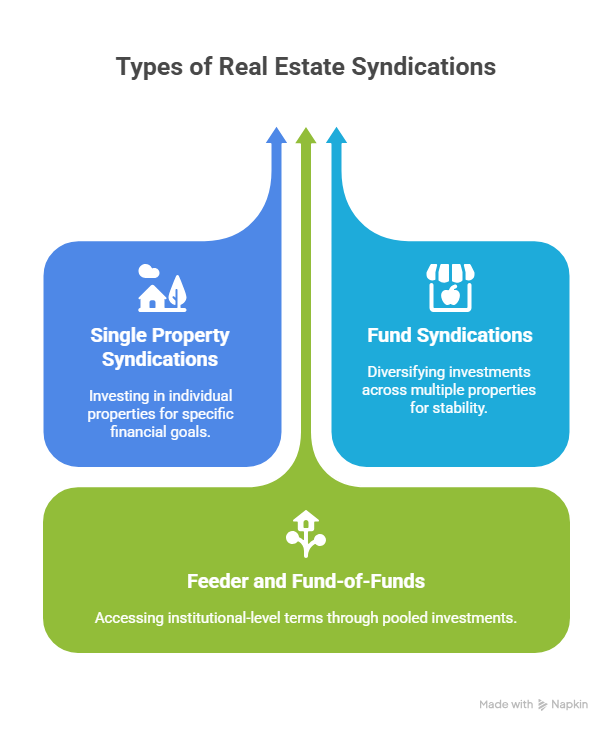

Investors entering the syndication space often assume all deals follow the same basic structure: a group pools money to buy a single, identified property. While this represents the most common opportunity you will encounter, limiting yourself to this single approach can restrict your ability to build truly diversified passive income streams.

Understanding the three distinct types of syndication deals—and their strategic advantages—empowers you to make deliberate choices that align with your wealth-building timeline and risk tolerance. Each structure serves different purposes in creating the abundant financial future that breaks your dependence on that paycheck.

Single Property Syndications

Single property syndications represent the foundation of most investors’ real estate portfolios. In these deals, your investment targets one specific asset, typically identified before capital raising begins. This transparency allows you to evaluate every detail—from neighborhood demographics to renovation plans—ensuring alignment with your investment criteria.

The clarity extends to your exit timeline. When the property sells, your investment concludes. This predictability makes single property syndications excellent tools for investors planning specific financial milestones, such as funding a child’s college education or supplementing retirement income at a target date.

However, this precision comes with inherent limitations for building robust passive income. Your returns depend entirely on one property’s performance. A single unexpected event—whether market conditions, natural disasters, or operational challenges—directly impacts your investment outcome. Even when your sponsor’s other properties exceed expectations, you experience only the results of your specific asset.

Beyond concentration risk, single property syndications create inefficiencies that reduce your overall returns. Each new investment requires separate legal documentation, regulatory filings, and administrative systems. These costs accumulate across multiple investments, creating drag on your wealth-building acceleration. The administrative burden also slows deal execution, potentially causing sponsors to miss opportunities in competitive markets.

For investors committed to building significant passive income streams, single property syndications work best as tactical investments within a broader, diversified approach.

Fund Syndications

Fund syndications address the primary weaknesses of single property deals by pooling multiple assets under one investment structure. Rather than owning a large stake in one property, you own smaller proportional interests across several properties, spreading both risk and opportunity.

This diversification creates more predictable income streams. While individual properties may underperform expectations, others typically compensate, smoothing your overall returns. For investors seeking to replace employment income with passive cash flow, this stability proves invaluable.

Fund structures also generate cost efficiencies that directly benefit your returns. Because there is a single syndication, the legal and administrative costs are typically lower. Sponsors can also move more quickly on opportunities, accessing better deals in competitive markets. These savings flow through to investors as improved returns.

The trade-off involves reduced transparency about specific investments. Fund documents outline target property types and geographic focus, but individual acquisitions typically occur after you commit capital. You maintain less control over specific asset selection, trusting your sponsor’s expertise to execute the stated strategy.

This structure suits investors prioritizing steady passive income growth over detailed involvement in individual property decisions. The diversification and efficiency benefits often outweigh the reduced transparency for those building long-term wealth.

Feeder and Fund-of-Funds Syndications

These structures create an additional layer between your investment and the underlying real estate. Your capital flows into a syndication that becomes a limited partner in other deals or funds, rather than directly owning property.

The primary advantage involves accessing investment terms typically reserved for much larger investors. Many syndications offer enhanced preferred returns, more favorable profit splits, and occasionally additional control rights to investors contributing significant capital—often starting at one million dollars or more. These structures allow smaller investors to pool resources and access these institutional-level terms.

Fund-of-funds structures may also provide diversification beyond what single sponsors can achieve. While individual fund syndications limit you to one general partner’s expertise and asset focus, fund-of-funds can spread investments across multiple sponsor teams and asset classes. This proves particularly valuable when building passive income across different real estate sectors where no single team maintains best-in-class expertise universally.

These benefits carry additional costs. You typically pay management fees to both your direct syndication and the underlying investments, reducing net returns. This fee is often offset by the better terms offered by the underlying deal. More significantly, your sponsor lacks direct control over underlying assets. They depend on other general partners for property management and strategic decisions, potentially limiting their ability to protect your interests during challenging periods.

The value of sponsor expertise in selecting underlying investments varies dramatically. The most effective fund-of-funds sponsors invest substantial resources in evaluating opportunities, conducting site visits across multiple markets, and thoroughly vetting partner teams. However, some sponsors provide minimal additional oversight, essentially collecting fees while accepting other sponsors’ representations without independent verification.

These funds primarily appeal to investors who are looking to maximize their diversification across sponsors and who want to delegate much of the due diligence process to one set of sponsors.

Summary

Each type of syndication serves specific purposes in building comprehensive passive income streams. Single property deals provide precision and learning opportunities, particularly valuable early in your investing journey. Fund syndications offer the diversification and efficiency needed for scaling wealth building. Fund-of-funds structures can provide access to premium terms and broader diversification without your having to invest millions.

Your selection criteria should align with your current financial position, timeline for achieving passive income goals, and comfort with varying levels of control and transparency. The most successful investors I observe typically utilize multiple syndication types, matching each investment to their specific objectives and market conditions.

This strategic approach to syndication selection accelerates your journey to financially independent investor, creating the abundant future where your wealth works as effectively as you do.

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.