When evaluating real estate investment opportunities, most investors focus primarily on location, asset class, and projected returns. While these factors are undeniably important, there is another critical element that can dramatically impact your investment outcomes: the capital stack. Understanding how a deal is financed and structured can mean the difference between achieving your expected returns and experiencing significant disappointment.

The capital stack represents the complete financing structure of a real estate investment, arranged in order of seniority and risk.

The Anatomy of a Real Estate Capital Stack

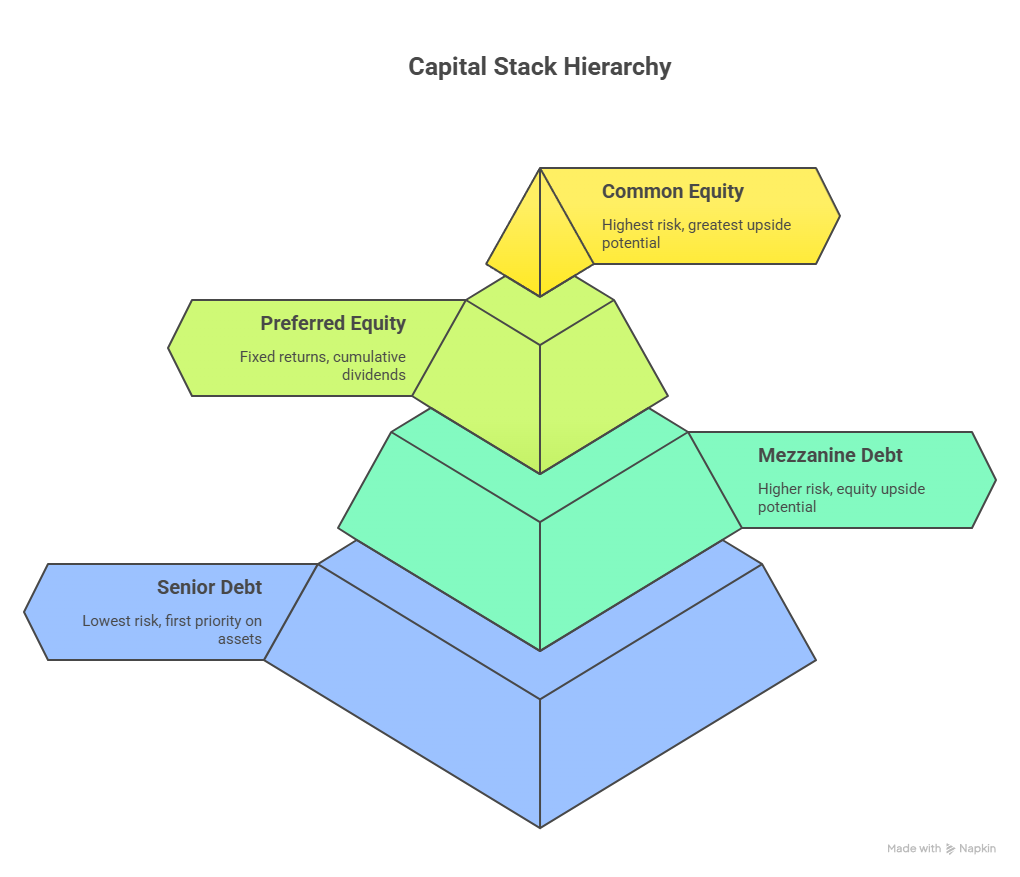

A typical real estate capital stack consists of several distinct layers, each with different risk profiles, return expectations, and rights. Not every deal has every layer, with some deals using only senior debt and common equity. The more layers used, the more important it is to understand where you are investing. From most senior to most junior, these layers typically include:

Senior Debt forms the base of most capital stacks, representing 60-75% of the total project cost. This debt carries the lowest risk and lowest returns, typically ranging from 5-9% annually. Senior lenders have first priority on both cash flow and asset value, meaning they get paid before anyone else. In the event of default, senior debt holders can foreclose on the property to recover their investment.

Mezzanine Debt occupies the middle ground. This layer carries higher risk than senior debt but lower risk than equity positions. Mezzanine lenders typically receive returns of 10-14% annually and may have some equity upside through warrants or conversion features. While subordinate to senior debt, mezzanine debt still receives priority over equity investors.

Preferred Equity sits above debt but below common equity. Preferred equity investors typically receive fixed returns of 8-12% annually and often have cumulative dividend features, meaning unpaid dividends accumulate and must be paid before common equity receives distributions. This position offers more stability than common equity while providing some upside potential.

Common Equity represents the most junior position in the capital stack. Common equity investors bear the highest risk but also have the greatest upside potential. These investors receive distributions only after all senior obligations are met, but they participate fully in any appreciation of the underlying asset.

How Capital Stack Structure Affects Your Returns

The structure of the capital stack directly impacts both the magnitude and timing of your returns. Understanding these relationships is crucial for making informed investment decisions.

Leverage Amplification represents one of the most significant impacts of capital stack structure. Consider a $10 million apartment acquisition with 70% senior debt at 6% interest and 30% equity investment. If the property appreciates by 20% over three years, the equity investors experience over a 60% return on their invested capital, while the debt holders receive their contracted 6% annually. However, this amplification works in both directions – losses are similarly magnified for equity investors, who do not receive any returns until all of the obligations to the debt holders have been paid off.

Because of how the different layers are paid off, the risk adjusted returns on the same deal can vary dramatically. Senior debt offers lower absolute returns, but have much less risk than equity positions because they get paid off before anyone else. Conversely, common equity positions offer higher potential returns but carry substantially more risk. Your personal risk tolerance and investment objectives should guide your preference for different positions in the stack.

Evaluating Capital Stack Quality

Not all capital stacks are created equal. Several factors distinguish well-structured deals from those that may present unnecessary risks or suboptimal return potential.

Appropriate Leverage Levels form the foundation of capital stack evaluation. Conservative leverage ratios typically range from 60-75% for stabilized assets and 70-80% for value-add opportunities. Higher leverage ratios may indicate aggressive assumptions about future performance or inadequate equity cushion to absorb potential setbacks. Conversely, too little leverage may reduce the ultimate investor returns if the deal performs as expected.

Leverage beyond 80-85% of total project costs often indicates aggressive underwriting assumptions or insufficient equity cushion. While higher leverage can boost equity returns in favorable scenarios, it dramatically increases the risk of capital loss if assumptions prove incorrect. This is the case even when your investment is the senior debt. As an example, one sponsor I have talked with funds value add deals with debt covering 100% of both the purchase and renovations. That means the lenders are taking all of the risk – if the renovation doesn’t increase the property value as expected, the sponsor can walk away losing nothing but their time while the lenders recoup less than their initial investment.

Debt Terms and Covenants significantly impact investment risk and flexibility. Fixed-rate debt provides stability but may limit refinancing opportunities, while floating-rate debt offers potential benefits in declining rate environments but introduces interest rate risk – as we saw over the past few years. Debt service coverage ratios, loan-to-value maintenance covenants, and prepayment penalties all affect the sponsor’s ability to manage the investment effectively. This can lead to the lenders forcing certain exit strategies that preserve their investments while negatively impacting the equity investors. Thus understanding not only the level of debt but the expected terms of the debt can give you better insight about whether or not the opportunity fits within your investment philosophy.

Capital Stack Evolution During the Investment Hold Period

The capital stack may also change during the investment hold period. Some of these changes are planned, while others may arise if the deal becomes distressed.

Refinancing Opportunities can significantly impact your investment returns. Properties that are performing well may qualify for refinancing at lower rates or higher loan amounts, potentially allowing for return of capital to equity investors while maintaining ownership. Having all of your capital returned because of a refinance can lead you to an “infinite return” model, where you have completely eliminated risk of a loss. Sponsors who intend to hold the property long term will often include refinancing as part of their invest management strategy.

Market Conditions affect different capital stack layers differently. Rising interest rates positively impact debt service costs and refinancing opportunities, while reducing the returns of equity positions. Similarly, increasing property values positively affect equity positions by increasing their returns while having no impact on senior debt. Understanding these relationships helps you evaluate how different market scenarios might affect your specific position.

Adding new layers in distress has unfortunately become a reality for many deals over the past 3 years. In this case, a new layer of preferred equity will be added to the deal. This doesn’t impact the lenders, since they still have priority, but can have a profound impact on the common equity investors. The preferred equity may allow the deal to flourish, providing the equity investors a return on their money that they would otherwise not see. Or it may capture all of the returns generated by the deal, reducing the common equity returns to zero. If you find a new layer being added to your deal after the initial funding has completed, you definitely want to take a hard look at what is happening to understand the impact of the change on your potential returns.

Optimizing Your Position Within the Capital Stack

Your investment objectives, risk tolerance, and market outlook should guide your preferences for different capital stack positions.

Income-Focused Strategies may favor debt or preferred equity positions that provide steady distributions with some upside potential. These positions offer more predictable cash flows and asset preservation opportunities than common equity.

Growth-Oriented Approaches typically emphasize common equity positions that provide maximum participation in asset appreciation. These positions are most suitable for investors who can tolerate return variability in exchange for higher potential returns.

Conclusion

The capital stack represents the foundation of every real estate investment opportunity. While it may seem like a technical detail compared to property location or renovation plans, it fundamentally determines your risk exposure, return potential, and overall investment experience.

The best deals often feature straightforward capital stacks with appropriate leverage levels, market-rate terms, and clear waterfall structures. Complexity is not necessary and usually is an indication of a poor deal when considering risk adjusted returns. Properties with sound underlying economics should not require exotic financing structures or excessive leverage to generate attractive returns. When you encounter such structures, dig deeper to understand what risks the sponsors may be trying to mitigate or what returns they may be trying to enhance through financial engineering rather than operational excellence.

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.