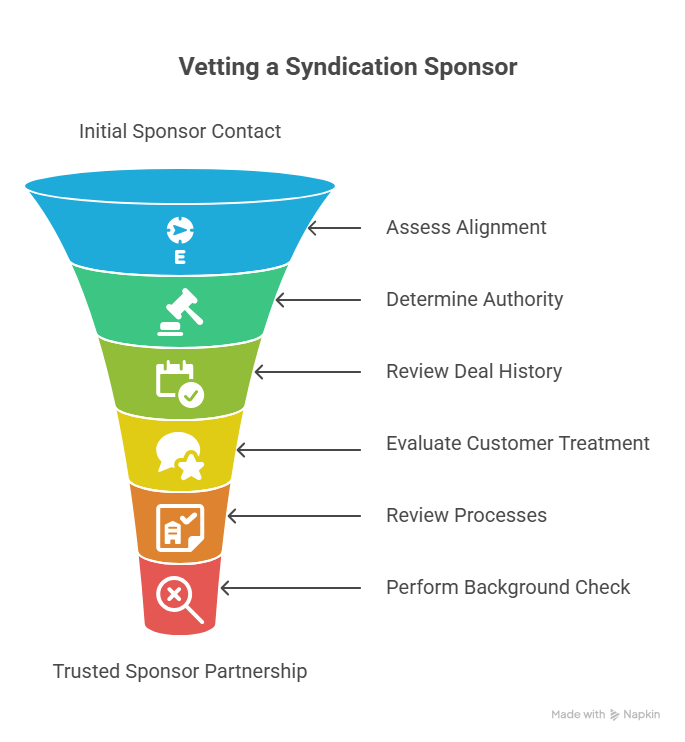

The most critical due diligence step for any passive investor involves thoroughly vetting the sponsor and team who will manage your investment. This principle cannot be overstated: an exceptional sponsor can transform a mediocre deal into a profitable venture, while an incompetent sponsor can destroy even the most promising opportunity.

Your success depends entirely on their execution, making it essential to understand exactly who you are partnering with. Unfortunately, identifying trustworthy sponsors requires significant effort and commitment. This reality underscores why I recommend conducting a preliminary deal analysis before investing time in sponsor evaluation [1]. Once you have identified an opportunity that interests you, the real work begins: determining whether you want to entrust your capital to this particular team.

Establishing Alignment

Your first step is to have a conversation with the sponsor to assess compatibility and shared vision. They don’t need to be someone you want to hang out with on the weekend, but your values and investment expectations must align. For instance, if you prioritize investments that contribute positively to communities and the sponsor emphasizes their commitment to providing affordable housing, this suggests compatible values. Conversely, if their focus centers solely on luxury amenities and celebrity endorsements, probably not.

During this alignment assessment, I recommend addressing the sponsor’s liquidity position. While this topic may feel uncomfortable, it is important. You cannot afford to partner with a sponsor who lacks the financial resources to address unexpected expenses that could jeopardize the investment. As part of this discussion, you should also establish how much they plan to personally invest beyond their management fees. Opinions vary regarding appropriate sponsor investment levels. My perspective focuses less on absolute amounts and more on the relative portion of their investable assets they are committing. The sponsor should have sufficient skin in the game to feel genuine consequences if the deal fails, while maintaining adequate liquidity to handle unexpected expenses necessary to preserve the investment.

Alignment alone is not sufficient vetting, but since you will partner with this sponsor for years, working with someone you trust and feel comfortable with makes both financial and practical sense.

Determining Decision Making Authority

Many times, your primary contact lacks ultimate decision-making authority. They may represent part of a larger team or depend entirely on an external operator [2]. It is common for individuals without actual decision-making power to handle investor relations and capital raising. You must understand precisely which decisions they can make independently and who controls other critical choices.

If your contact cannot unilaterally buy or sell the property, make financing decisions, or replace the operator, you need to identify exactly who holds these authorities. These decisions may require team consensus or rest with someone entirely different from your primary contact. You must include all decision-makers in your vetting process since they will make key choices that directly impact your investment returns.

Understanding Their Deal History

While past performance does not guarantee future results, examining a sponsor’s track record provides valuable insights into their strengths and weaknesses.

When reviewing previous deals, I begin with fundamental questions: Have they completed transactions in the same asset class at similar scale as the current opportunity? If not, do their previous investments demonstrate logical progression toward this deal? An investor who has successfully managed multiple four-unit properties moving to a ten-unit building shows reasonable progression. The same investor jumping to a 100,000-square-foot self-storage facility represents an entirely different risk profile.

I am seeking evidence that they have gained the experience necessary to manage the proposed property successfully. While similar previous experience is not the only path to relevant expertise, it certainly demonstrates capability.

I examine how their business has evolved over time. Are they scaling faster than previously? For example, if they historically closed one deal every three years but are now pursuing their third transaction this year, I want to understand how they are managing this acceleration successfully.

Additionally, I assess whether their role has changed over time. If they previously focused primarily on investor relations but now must manage operations, finances, and investors simultaneously, their experience in these expanded responsibilities becomes crucial. Similarly, if the team composition has changed significantly—such as losing a senior decision-maker from previous deals—I need confidence that the current team possesses the expertise required for success.

Obviously, when looking at their history, understanding the existing deal performance is a focus. For both completed and ongoing investments, I compare actual results against original projections. While I do not expect perfect adherence to projections, understanding where and why differences occur provides valuable insights. I pay particular attention to any history of distribution pauses, capital calls, capital stack changes, or foreclosures. While distribution pauses can represent proactive property protection, the other situations typically indicate deal distress and probable investor losses. I want to understand what caused these issues and, specifically, whether the sponsor could have taken actions to mitigate these risks.

Fundamentally, I am looking for evidence that the sponsor can create value through skill and effort, not merely ride favorable market conditions to success. As I result, I do not automatically exclude sponsors who have lost investor money—this can happen to anyone. However, I want to understand what lessons they learned and what changes they have implemented to prevent future losses.

Evaluating Customer Treatment

Sponsors serve two distinct customer groups in real estate deals, and their treatment of both reveals important insights.

The first group is the property tenants. Unless you are investing in NNN commercial space, the operator must work closely with tenants to address property concerns. Their interaction with existing tenants provides strong indicators of how they will manage tenants in your investment property. I recommend reviewing Google reviews for properties in the sponsor’s current portfolio. For thorough evaluation, you might even conduct anonymous property visits to experience their tenant treatment firsthand.

The second customer group comprises existing investors. I want to see examples of their current investor communications, such as newsletters and webinars, to understand the quality and frequency of information they provide. I also check my network to see if anyone has invested with them previously. In many cases, sponsor reputations—both positive and negative—precede them. Network checking can provide valuable insights. Additionally, several sites allow limited partners to review sponsors. My current preference is Invest Clearly [3], which ensures reviews come from verified investors and allows anonymous feedback—helpful when someone wants to provide honest criticism without legal concerns.

I also request references directly from the sponsor. Obviously, they will provide their most satisfied investors, but these conversations can still reveal surprising information. At minimum, you can confirm whether their experience matches your intended asset class and whether they have continued investing with the sponsor beyond their initial deal.

Reviewing Their Processes

Professional sponsors should maintain consistent processes for every deal. I want to understand these systems, particularly their due diligence and financial tracking procedures.

For due diligence, I look for detailed checklists that sponsors follow when evaluating every opportunity. I expect multiple due diligence stages—from initial paper review through detailed record examination to on-site inspections and professional evaluations. While I want to see their entire process, I focus more on ensuring they have a systematic approach they follow consistently rather than scrutinizing every detail.

For financial management, I seek evidence of checks and balances that prevent fund misappropriation. While I do not expect smaller sponsors to conduct annual audits due to their expense, I do look for this practice among larger sponsors. Regardless of size, however, there should be safeguards preventing anyone from misappropriating funds.

These processes reflect the sponsor’s commitment to consistency and integrity—values that align with building lasting partnerships.

Performing Formal Background Check

Historically, I conducted few formal background checks. However, as my investment portfolio has grown, I increasingly perform them on potential new sponsors. The reason is simple: sponsors can easily hide their track records. For most sponsors, the only source of deal history is their own disclosure. If they omit information about a deal, discovering it independently becomes extremely difficult.

Formal background checks address this information gap. Basic services like Checkr perform initial background screening, revealing bankruptcies, criminal history, and similar issues. These services work well for tenant and employee screening but poorly for understanding business deal history, which typically connects to businesses rather than individuals personally. Instead, I use companies that specialize in comprehensive background investigations. These firms look beyond personal history into detailed business dealings and seek to identify behavioral patterns. My current preference is Aegis RSI [4], though other quality options exist. While these services cost significantly more than basic screening, given the investment amounts involved in syndication deals, I believe the expense is justified.

Scaling Efficiency

Sponsor vetting can require days to weeks and cost several hundred dollars. While this represents a significant investment of time and money, it constitutes an essential component of your limited partner due diligence.

The good news is that once you have identified and approved a sponsor, you can continue partnering with them on future deals without repeating this entire process. I use this approach to short-cut my evaluation process and move directly to deal analysis, saving both time and money.

Using your established experience with a sponsor does not eliminate investment risk entirely, but since the probability of discovering new concerning information after thorough initial research is lower, it can significantly reduce the workload required when exploring new offerings from proven partners.

This creates a potential win-win situation: you reduce your evaluation costs and timeline while building deeper, more profitable relationships with quality sponsors who have demonstrated their capability and integrity.

For additional reading:

- https://www.mbc-rei.com/blog/71-quickly-eliminate-deals-that-dont-work/

- https://www.mbc-rei.com/blog/65-understanding-gp-operator-relationships-critical-due-diligence/

- https://investclearly.com/

- https://www.aegisrsi.com/

The complete set of newsletter archives are available at:

https://www.mbc-rei.com/mbc-thoughts-on-passive-investing/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.