As your syndication portfolio grows, you will face a new challenge: too many opportunities and not enough time to evaluate them all. This abundance of options represents a significant shift in your investment journey. Where you once searched desperately for any deal, you now must become selective, strategic, and efficient in your evaluation process.

The reality is that most syndication opportunities that cross your desk will not deserve your investment dollars. Learning to identify the promising deals quickly while discarding the rest is a critical skill that separates successful passive investors from those who either miss great opportunities or waste precious time on mediocre ones.

The Four-Stage Elimination Process

I have developed a systematic approach that allows me to eliminate the majority of deals in under five minutes in the first stage. This rapid screening process protects my most valuable resource—time—while ensuring I never overlook a genuinely compelling opportunity.

Stage One: The Immediate Disqualifiers

Investment Thesis Alignment

The first filter asks a simple question: Does this deal align with my clearly defined investment thesis [1, 2, 3]? By knowing exactly what I seek to invest in, I can quickly eliminate opportunities that clearly miss the mark. For example, if a deal focuses on growth appreciation rather than cash flow generation, or targets an asset class outside my comfort zone, it receives an immediate pass regardless of other factors.

This filter requires you to have done the foundational work of defining your investment criteria. Without clear parameters, you cannot efficiently eliminate unsuitable opportunities.

Relationship Prerequisites

The second filter examines the sponsor relationship. Over the past several years, I have observed a troubling trend: sponsors mass-marketing deals to investors without any attempt to establish genuine relationships [4]. These unsolicited pitches immediately eliminate a deal from my consideration.

Why is this relationship factor so critical? Syndication investing is fundamentally about people. You are entrusting your capital to individuals who will make countless decisions affecting your investment over multiple years. A sponsor who begins the relationship by treating you as nothing more than a checkbook demonstrates a transactional approach that rarely leads to successful outcomes.

Unfortunately, this trend will persist as long as investors continue responding to these mass-market approaches. By consistently rejecting deals from sponsors who have not invested time in relationship-building, you send a clear market signal about professional standards.

Stage Two: The 30-60 Minute Pitch Deck Analysis

The pitch deck review represents your first substantial time investment in any deal. I typically allocate 30-60 minutes for this analysis.

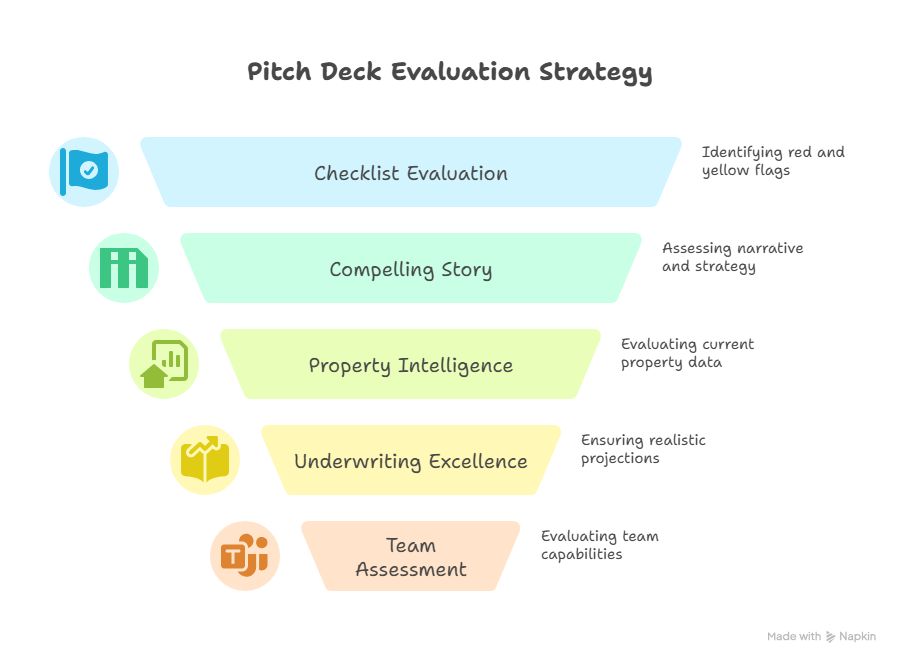

To bring objectivity to pitch deck evaluation, I use a scoring system based on red flags (immediate disqualifiers) and yellow flags (areas of concern). This framework prevents emotional decision-making and provides consistent evaluation criteria.

Scoring Framework:

- Comprised of both a checklist and 4 key components

- Red Flag = 10 points: Immediate disqualification

- Yellow Flag = 3 points: Significant concern requiring explanation

- Maximum acceptable score = 9 points: This allows for up to three yellow flags but no red flags

Checklist

Red Flag Indicators (10 points each):

- Inadequate Underwriting: Rental rates and expenses moving in lockstep, or single line item for “Operating Expenses”

- Unrealistic Exit Assumptions: Planning for exit cap rates lower than purchase cap rates

- Incomplete Capital Structure: Missing details about fees, waterfall, or investor protections

Yellow Flag Indicators (3 points each):

- Unquantified Value Creation Claims: Terms like “growth” and “value-add” used without supporting numbers and sources

- Vague Investment Thesis: Lacking a clear, compelling 1-2 paragraph summary of the opportunity

- Insufficient Property Intelligence: Missing current market demographics, vacancy rates, or immediate capital needs

- Limited Exit Strategy Planning: Single exit strategy without contingency planning

- Incomplete Team Information: Missing key team members like operators, accountants, or legal counsel

- Poor Due Diligence Evidence: Relying exclusively on broker photos or Google Maps imagery

- Unclear Entity Structure: Failing to explain relationships between various entities involved

Component 1: The Compelling Investment Story

Every exceptional syndication opportunity should articulate a clear, compelling narrative about value creation. This story should answer three fundamental questions:

- What are other buyers missing about this property? Great deals often exist because the seller or other potential buyers have overlooked value creation opportunities that your sponsor has identified.

- How will the projected returns be generated? Specific strategies for increasing income, reducing expenses, or both should be clearly outlined with supporting market data.

- What is the realistic exit strategy? Multiple exit scenarios with corresponding timelines should be presented, along with contingency plans if primary strategies encounter obstacles.

Add 4 points for each piece of information that is missing.

Component 2: Current Property Intelligence

Understanding the property’s current state is essential for evaluating both opportunity and risk. Comprehensive pitch decks should provide:

- Current vacancy rates and lease terms

- Tenant profiles and payment histories

- Immediate maintenance needs and capital expenditures

- Local market demographics and economic trends

- Crime statistics and neighborhood safety considerations

- Traffic patterns (for commercial properties)

- Environmental concerns including flood zones or contamination

This information should be current, specific, and sourced from reliable data providers rather than general market assumptions. If it is not provided, add 3 points.

Component 3: Underwriting Excellence

Superior underwriting demonstrates deep market knowledge and realistic projections. Quality underwriting should:

- Account for all closing-related changes: Property tax adjustments, new insurance quotes, and transfer costs

- Incorporate specific market knowledge: Current rental rates, expense ratios, and trend analysis for the specific submarket

- Provide detailed expense breakdowns: Individual line items rather than catch-all categories

- Include sensitivity analysis: How changes in key assumptions affect overall returns

- Demonstrate conservative assumptions: Especially regarding rent growth and expense control

Add 1 point for each piece of missing information.

Component 4: Team Assessment

Syndication success depends entirely on team execution. Even brilliant strategies fail without capable teams. Evaluate:

- General Partner experience: Track record with similar properties and market conditions

- Property management capabilities: Either in-house expertise or established operator relationships

- Professional support network: Experienced accountants, attorneys, and contractors

- Local market knowledge: Deep understanding of the specific submarket and its dynamics

If the team doesn’t meet your expectations, add 10 pts. If the team appears to be missing key members, but the people identified otherwise look good, add 3 points (if not already added as part of the checklist).

The Abundance Mindset in Deal Selection

This selective approach stems from abundance, not scarcity. More quality syndication opportunities exist than you have capital to invest. This reality should liberate you from the fear of missing out on any single deal.

The opportunity cost of investing in a mediocre deal is not just the potential for poor returns—it is the loss of capital that could have been deployed in a superior opportunity. By maintaining high standards and efficient evaluation processes, you position yourself to recognize and act upon the truly exceptional deals that align with your investment thesis and financial goals.

Your time is your most valuable asset in this process. Protecting it through systematic evaluation ensures you can focus your energy on the opportunities that genuinely deserve your capital and attention.

Assuming that the pitch deck passes muster, then I move next to reviewing the sponsor (stage 3) and finally to a more detailed review of the deal itself (stage 4). I will share more information about those stages in future articles.

For additional reading:

- https://www.mbc-rei.com/blog/61-establishing-your-investment-thesis-part-1-define-your-goal/

- https://www.mbc-rei.com/blog/62-establishing-your-investment-thesis-part-2-clarify-your-strategy/

- https://www.mbc-rei.com/blog/63-establishing-your-investment-thesis-part-3-determine-your-tactics/

- https://www.mbc-rei.com/blog/58-two-unfortunate-trends-in-sponsor-communication/

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.