If you spend time in real estate investing circles, you will encounter a curious phenomenon: many seasoned real estate investors entirely dismiss stock market investing. Syndicators, in particular, seem to share a universal set of complaints about traditional securities::

- You don’t have any control

- The market is incredibly volatile

- There is no cash flow from stocks

- You can’t leverage your investments

- The tax benefits of real estate are better

- Wall street is just charging you huge fees

- All of the wealthy people have money in real estate

- Retirement accounts lock up your money until you retire

These criticisms contain elements of truth, but they present an incomplete picture while ignoring the compelling reasons why stock market investing represents the right starting point for most people. What these critics overlook is that stocks, particularly index funds, offer distinct advantages:

- Are fully passive

- Have very low fees

- Generate dividends

- No minimum investment

- Provide immediate liquidity

- Have historically gone up 10%/yr

- Require very little to start investing

- Have created the wealthiest people in the world (Buffet, Bezos, Gates, Zuckerberg, etc.)

The irony becomes apparent when you examine real estate syndications against their own criticisms of stock investing. Syndications often:

- Do not provide their LPs any control

- Require locking up your money for 5+ years

- Have fees significantly higher than index funds

- Require minimum $50,000 or $100,000 investment

- Do not generate many tax benefits for W-2 earners

- Use leverage that can generate 100% loss of your investment

- Still have to deal with market volatility – in rents, cap rates, interest rates, etc.

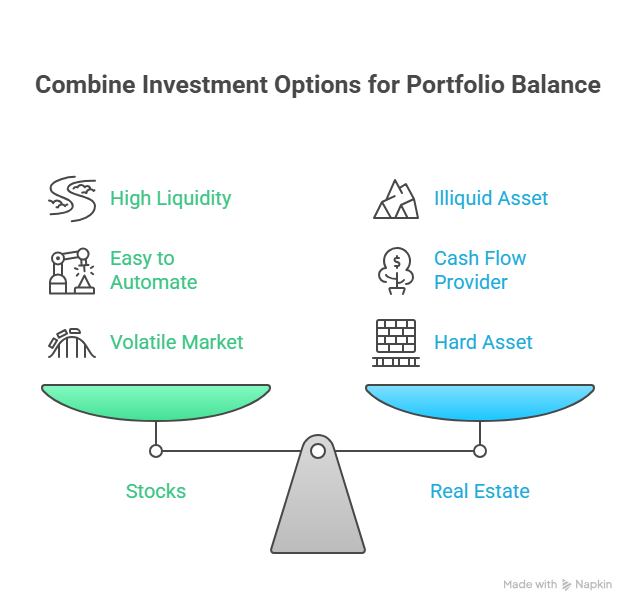

Many real estate investors appear to have embraced a narrative that Wall Street exists solely to extract investor capital, concluding that stocks and bonds have no place in a well-constructed portfolio. The reality is that both asset classes offer unique benefits and serve different purposes in a comprehensive wealth-building strategy. Rather than choosing sides in an artificial competition, successful investors recognize that combining both approaches creates a more robust foundation for achieving financial independence.

Stocks Form the Foundation

The stock market is an excellent foundation for your investment portfolio. You can begin with modest amounts and watch them compound over time through the power of consistent investing. Index funds offer particular advantages for busy professionals: minimal fees (many brokerages charge zero transaction costs with ongoing expenses under 0.1%), broad market exposure, and diversification across hundreds or thousands of companies.

This diversification provides more stability than picking individual stocks while dramatically reducing your risk of total loss. When you invest through tax-advantaged retirement accounts, you unlock additional benefits including tax deferrals and potential employer matching contributions – essentially free money that accelerates your wealth building. Perhaps most importantly, stock market investing can operate completely on autopilot. Once you establish your investment strategy and set up automatic transfers, the system works without requiring ongoing decisions or time commitments.

Real Estate is Next Level Investing

Reaching true paycheck independence often requires expanding beyond traditional securities. Real estate syndications offer three compelling advantages that complement your existing portfolio:

- Further diversification of assets

- Leveraging other people’s expertise

- Cash flow

Real estate moves differently than stocks. While stock prices can fluctuate dramatically based on market sentiment, corporate earnings, or economic news, real estate values tend to change more gradually and follow different patterns. This low correlation with stock market movements helps stabilize your overall portfolio during market volatility. Real estate also provides a natural hedge against inflation. As the cost of living increases, property values and rental income typically rise accordingly, preserving and growing your purchasing power over time. Unlike stocks, which represent ownership in companies that could theoretically become worthless, real estate investments are backed by tangible assets with intrinsic value.

Real estate syndications transform investing from a solo endeavor into a team sport. By partnering with experienced sponsors and other investors, you gain access to deals and expertise that would be impossible to achieve individually. These partnerships enable you to participate in larger, institutional-quality properties that generate better returns and benefit from professional management. This collaborative approach provides access to top-tier real estate professionals – acquisition specialists, property managers, construction teams, and legal experts – without requiring you to build these relationships yourself. You retain the benefits of property ownership, including favorable tax treatment and income generation, while leveraging others’ specialized knowledge and experience.

Cash flow is my major reason for expanding into real estate, since I was looking to leave work before I could access my retirement accounts [1]. This cash flow provides remarkable flexibility. Regular distributions cover living expenses without selling investments, while the underlying properties continue appreciating in value. Due to depreciation benefits, much of this cash flow may be tax-deferred until selling the property, giving more spending power than equivalent stock dividends after taxes.

Cash flowing real estate gives you great flexibility. It generates income streams that allow you to offset expenses without having to sell off assets. At the same time, the underlying asset continues to grow in value, increasing your overall investment portfolio. Furthermore, because of the benefits of depreciation, it is likely that much of this cash flow will be tax deferred until the sale of the property, giving you more purchasing power than you would get from stock dividends.

Real estate investing requires significantly more involvement than stock market investing, making it less suitable as a starting point for most investors. Before expanding your portfolio, consider these important factors:

- Active Time Investment Required: Real estate syndications cannot be automated like index fund investments. Each opportunity requires individual evaluation, legal document review, and active decision-making. Even after establishing relationships with trusted sponsors, you must assess how each deal fits your portfolio strategy and risk tolerance.

- Personal Due Diligence Responsibility: Unlike publicly traded companies with extensive analyst coverage and regulatory oversight, private real estate deals rely on your personal evaluation. You must develop investment criteria, research sponsor track records, understand market conditions, and analyze deal structures. Delegating this responsibility to others does change the fact that you ultimately bear the consequences of your investment decisions.

- Loss Potential: While real estate provides asset backing, leverage amplifies both gains and losses. Unlike diversified index funds, you could lose your entire investment in a poorly performing deal. Various factors including market downturns, operational challenges, or sponsor mistakes can result in significant losses.

- Concentrated Investment Risk: Minimum investments typically range from $50,000 to $100,000, with some exceeding $1 million. These large minimums can represent a substantial portion of your portfolio, limiting your ability to diversify across multiple properties and increasing your exposure to individual deal risk.

- Increased Complexity: Real estate syndications involve sophisticated legal structures, tax implications including K-1 forms, and potential multi-state filing requirements. The capital stack structure determines your investment priority and risk level. You and your professional team must understand and manage this complexity effectively.

The Balanced Approach to Wealth Building

The most effective investment strategy for achieving financial independence combines elements of both stock and real estate investing rather than choosing one exclusively. This balanced approach provides multiple income streams, risk mitigation, and flexibility to adapt to changing circumstances. It also offers the recurring cash flow necessary to reduce paycheck dependency while maintaining long-term growth potential and liquidity options for unexpected opportunities or challenges.

The key lies in building systematically, starting with a solid foundation of low-cost index funds, then expanding into real estate syndications as your knowledge, network, and investment capital grow. This allows you to maintain the benefits of passive investing while adding the enhanced returns and cash flow potential that real estate can provide.

True financial freedom comes not from perfecting a single investment strategy, but from creating multiple income streams that work together to support your abundant life while reducing your dependence on any single source of income.

For additional reading:

This article is my opinion only, it is not legal, tax, or financial advice. Always do your own research and due diligence. Always consult your lawyer for legal advice, CPA for tax advice, and financial advisor for financial advice.